Economics Today 18th Edition by Roger LeRoy Miller

النسخة 18الرقم المعياري الدولي: 978-0133882285

Economics Today 18th Edition by Roger LeRoy Miller

النسخة 18الرقم المعياري الدولي: 978-0133882285 تمرين 2

The Fed's Acquisition of Treasury Debts: QE1, QE2, and QE3

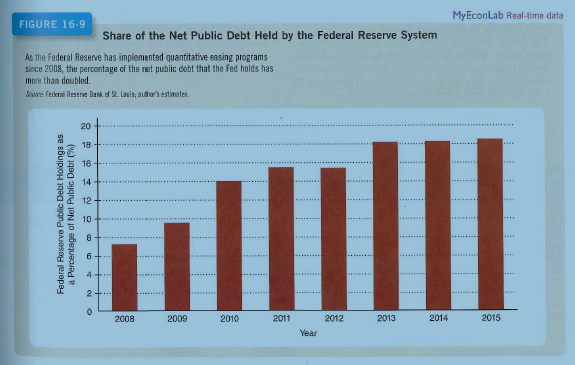

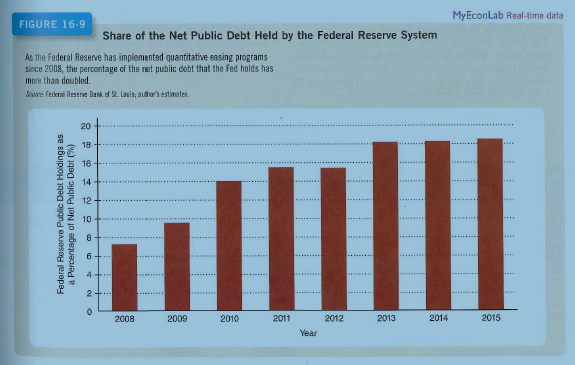

Since 2008, the Fed has conducted three quantitative easing policy programs: QE1-$1.6 trillion, November 2008-March 2009; QE2-$600 billion, November 2010-June 2011; and QE3-$1.6 trillion, September 2012-October 2014. During QE1, many of the securities that the Fed bought were short-term, 3-to-6-month-maturity securities that the U.S. Treasury since has paid off. QE2 and QE3, however, involved more purchases of longer-term Treasury debts that have not been paid off. Consequently, as shown in Figure 16-9, the Fed's share of the net public debt out-standing has grown considerably, to more than 18 percent.

Benefits for the U.S. Treasury, but Monetary Concerns The Fed's credit policies have sought to stabilize the banking system, but the combination of its credit and monetary policies has also been a boon to the U.S. Treasury. The Fed does not purchase newly issued securities directly from the U.S. Treasury, but the Fed's policies have held down market interest rates and hence the U.S. Treasury's costs of borrowing.

The Fed has paid interest to banks to induce them to hold reserves with the Fed, which the Fed in turn has used to fund its QE and credit-policy programs. Hence, the Fed's substantial expansion of reserves has not generated a significant increase in the money supply. As a result, even though the Fed's current share of ownership of the net public debt is at its highest since the 1970s, the rate of money growth has remained lower than it was in that earlier decade.

According to the quantity equation, if the U.S money growth rate were to double as a consequence of the Fed's quantitative easing policies, what would be the effect on the inflation rate, other things being equal?

Since 2008, the Fed has conducted three quantitative easing policy programs: QE1-$1.6 trillion, November 2008-March 2009; QE2-$600 billion, November 2010-June 2011; and QE3-$1.6 trillion, September 2012-October 2014. During QE1, many of the securities that the Fed bought were short-term, 3-to-6-month-maturity securities that the U.S. Treasury since has paid off. QE2 and QE3, however, involved more purchases of longer-term Treasury debts that have not been paid off. Consequently, as shown in Figure 16-9, the Fed's share of the net public debt out-standing has grown considerably, to more than 18 percent.

Benefits for the U.S. Treasury, but Monetary Concerns The Fed's credit policies have sought to stabilize the banking system, but the combination of its credit and monetary policies has also been a boon to the U.S. Treasury. The Fed does not purchase newly issued securities directly from the U.S. Treasury, but the Fed's policies have held down market interest rates and hence the U.S. Treasury's costs of borrowing.

The Fed has paid interest to banks to induce them to hold reserves with the Fed, which the Fed in turn has used to fund its QE and credit-policy programs. Hence, the Fed's substantial expansion of reserves has not generated a significant increase in the money supply. As a result, even though the Fed's current share of ownership of the net public debt is at its highest since the 1970s, the rate of money growth has remained lower than it was in that earlier decade.

According to the quantity equation, if the U.S money growth rate were to double as a consequence of the Fed's quantitative easing policies, what would be the effect on the inflation rate, other things being equal?

التوضيح

A major hindrance in the money creation ...

Economics Today 18th Edition by Roger LeRoy Miller

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255