Macroeconomics 1st Edition by Dean Karlan,Jonathan Morduch

النسخة 1الرقم المعياري الدولي: 978-0077332648

Macroeconomics 1st Edition by Dean Karlan,Jonathan Morduch

النسخة 1الرقم المعياري الدولي: 978-0077332648 تمرين 13

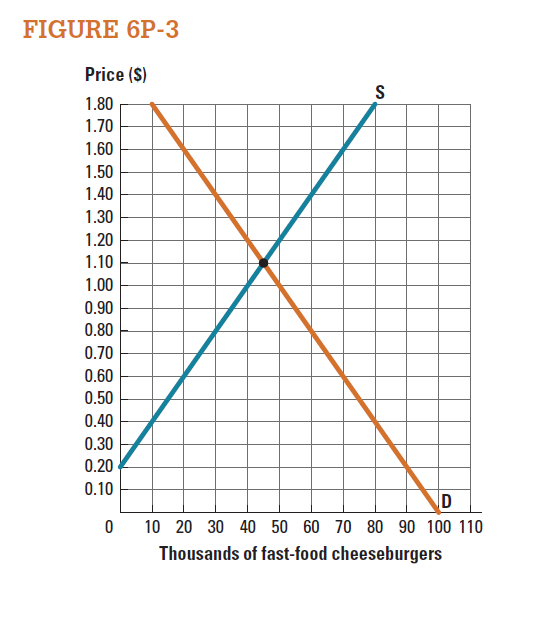

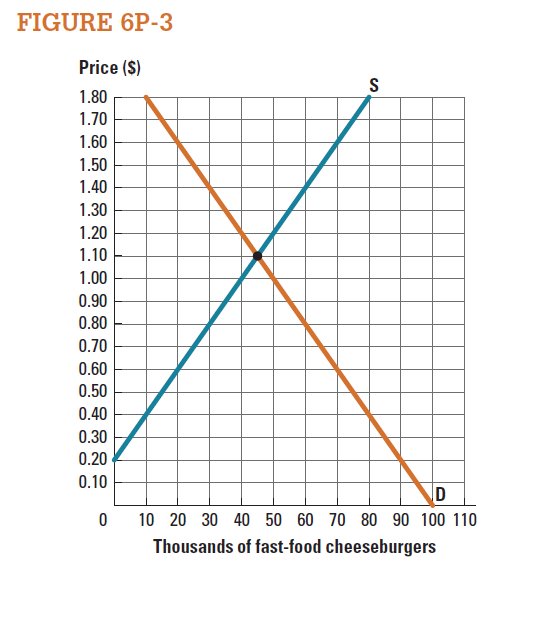

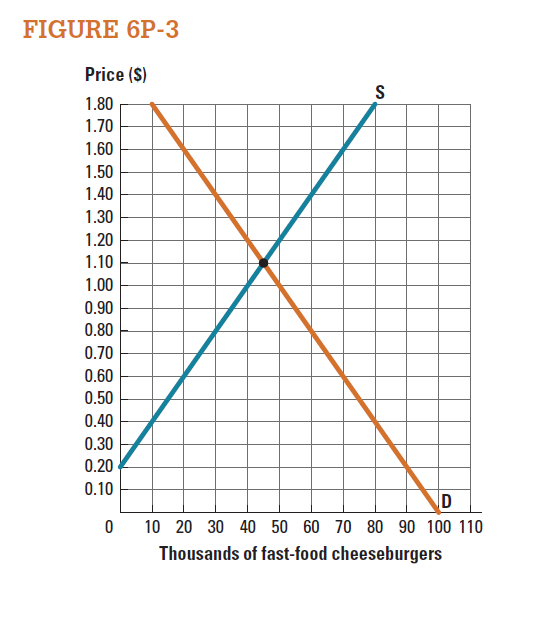

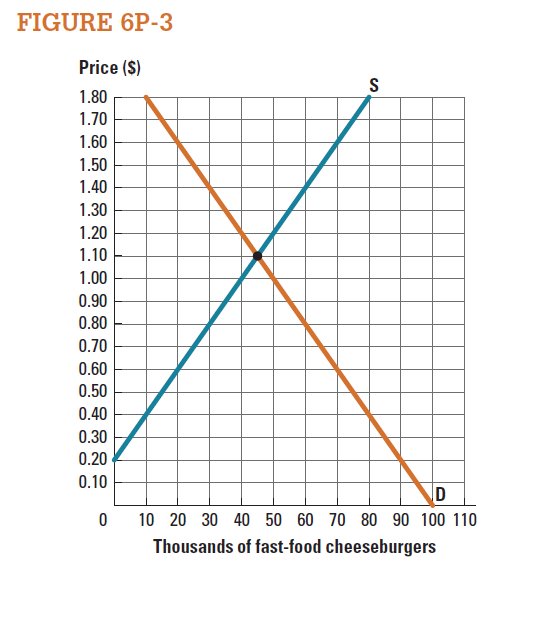

The weekly supply and demand for fast-food cheeseburgers in your city is shown in Figure 6P-3. In an effort to curb a looming budget deficit, the mayor recently proposed a tax that would be levied on sales at fast-food restaurants.

a. The mayor's proposal includes a sales tax of 60 cents on cheeseburgers, to be paid by consumers. What is the new outcome in this market (how many cheeseburgers are sold and at what price)? Illustrate this outcome on your graph.

b. How much of the tax burden is borne by consumers? How much by suppliers?

c. What is the deadweight loss associated with the proposed tax?

d. How much revenue will the government collect?

e. What is the loss of consumer surplus from this tax?

a. The mayor's proposal includes a sales tax of 60 cents on cheeseburgers, to be paid by consumers. What is the new outcome in this market (how many cheeseburgers are sold and at what price)? Illustrate this outcome on your graph.

b. How much of the tax burden is borne by consumers? How much by suppliers?

c. What is the deadweight loss associated with the proposed tax?

d. How much revenue will the government collect?

e. What is the loss of consumer surplus from this tax?

التوضيح

a.Diagram:

Figure -1 illustrates the im...

Macroeconomics 1st Edition by Dean Karlan,Jonathan Morduch

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255