Macroeconomics 1st Edition by Dean Karlan,Jonathan Morduch

النسخة 1الرقم المعياري الدولي: 978-0077332648

Macroeconomics 1st Edition by Dean Karlan,Jonathan Morduch

النسخة 1الرقم المعياري الدولي: 978-0077332648 تمرين 19

Assume that a subprime mortgage involves a loan of $1,000 and is to be paid back in full with 30 percent interest after one year.

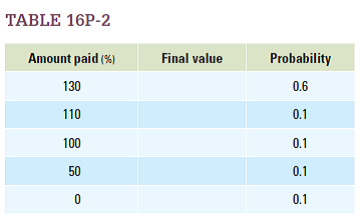

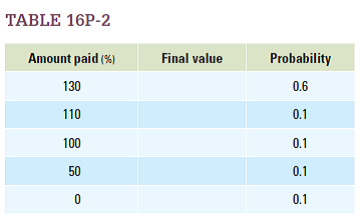

a. Sometimes borrowers will not be able to pay off the entire mortgage or may default entirely. Calculate the final amount of money an investor earns under the payback rates shown in Table 16P-2. (Note that a rate of 130 percent means that the whole loan is paid off, plus the additional 30 percent of interest.) b. Assume investors are unwilling to invest in these loans unless the expected rate of return is 10 percent.

Calculate the expected rate of return for this loan by adding up all of the products of the final value and the probability that that value will occur. Will investors want to invest in this loan?

a. Sometimes borrowers will not be able to pay off the entire mortgage or may default entirely. Calculate the final amount of money an investor earns under the payback rates shown in Table 16P-2. (Note that a rate of 130 percent means that the whole loan is paid off, plus the additional 30 percent of interest.) b. Assume investors are unwilling to invest in these loans unless the expected rate of return is 10 percent.

Calculate the expected rate of return for this loan by adding up all of the products of the final value and the probability that that value will occur. Will investors want to invest in this loan?

التوضيح

a.Expected value:

Expected value can be...

Macroeconomics 1st Edition by Dean Karlan,Jonathan Morduch

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255