Macroeconomics 1st Edition by Dean Karlan,Jonathan Morduch

النسخة 1الرقم المعياري الدولي: 978-0077332648

Macroeconomics 1st Edition by Dean Karlan,Jonathan Morduch

النسخة 1الرقم المعياري الدولي: 978-0077332648 تمرين 23

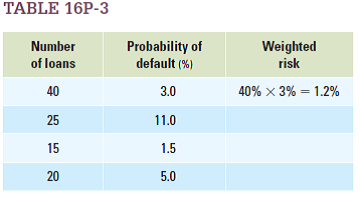

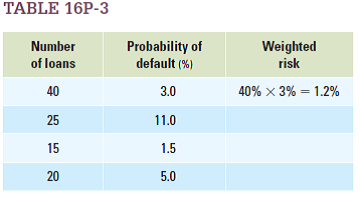

A single bank is considering two options: First, it can make a $200,000 mortgage loan for a customer with a 10 percent probability of default, or, second, it can buy a $200,000 security representing a bundle of 100 mortgage loans, which break down as shown in Table 16P-3.

You can calculate the weighted risk for each firm category by multiplying the percentage of loans represented (for example, the first tier includes 40 loans, which is 40 ___ 100 5 40% of the total) times the probability of default on loans of that category. Do so for each type of loan, then add together the weighted risks to come up with an overall expected default risk for this financial investment. If the bank is willing to take on only projects for which the default risk is 6 percent or less, which option(s) should it choose?

You can calculate the weighted risk for each firm category by multiplying the percentage of loans represented (for example, the first tier includes 40 loans, which is 40 ___ 100 5 40% of the total) times the probability of default on loans of that category. Do so for each type of loan, then add together the weighted risks to come up with an overall expected default risk for this financial investment. If the bank is willing to take on only projects for which the default risk is 6 percent or less, which option(s) should it choose?

التوضيح

Given:

• Option 1 includes a $200,000 m...

Macroeconomics 1st Edition by Dean Karlan,Jonathan Morduch

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255