Auditing and Assurance Services 1st Edition by Iris Stuart

النسخة 1الرقم المعياري الدولي: 978-0073404004

Auditing and Assurance Services 1st Edition by Iris Stuart

النسخة 1الرقم المعياري الدولي: 978-0073404004 تمرين 47

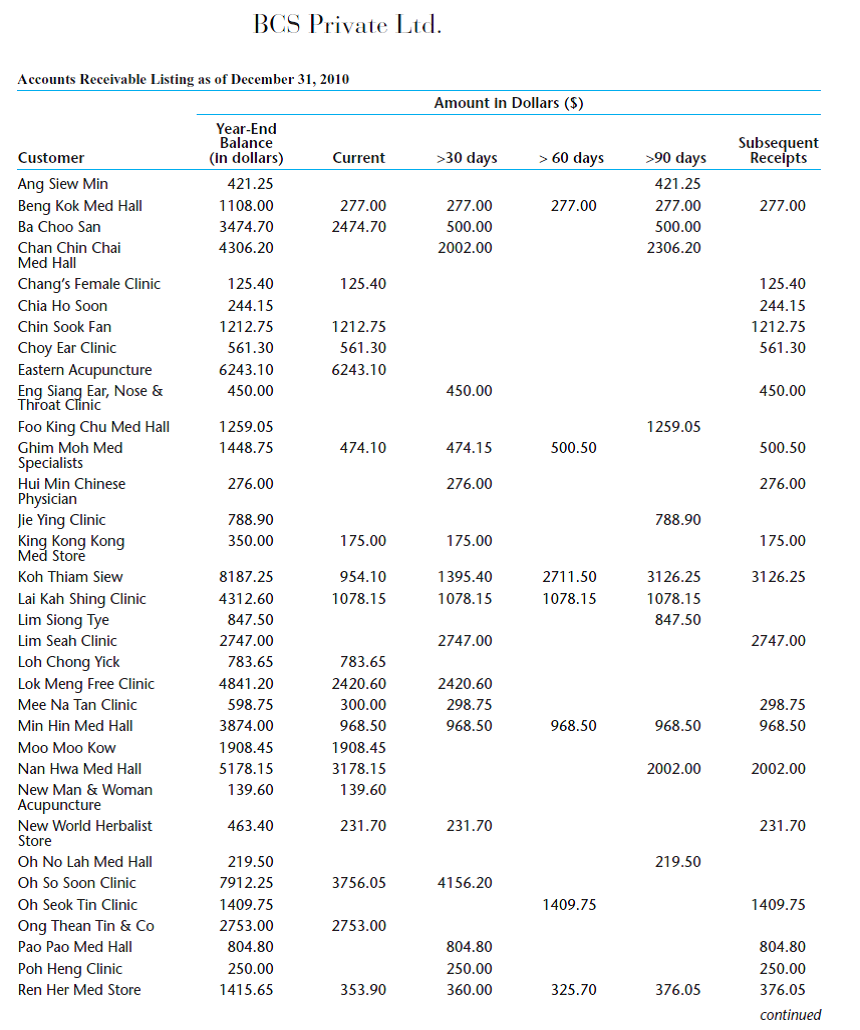

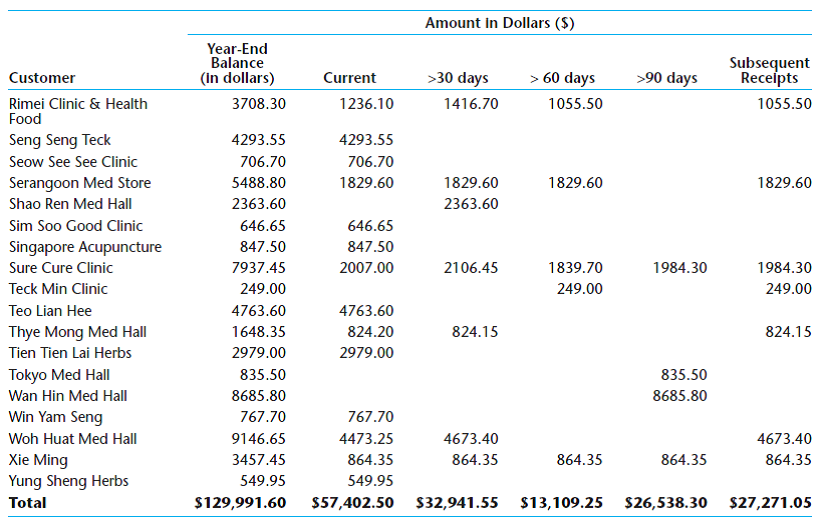

Evaluating the allowance for doubtful accounts. See Appendix B for the aged receivables trial balance for BCS. Review it and explain what the information in each column represents.

a. Use this information to calculate a bad debt provision for BCS at December 31, 2010 Last year BCS used the following percentages to calculate the bad debt provision: current accounts, .05%; 30 day accounts, 2%; 60 day accounts, 10%; 90 day accounts, 40%. First calculate the allowance using the percentages applicable in the previous year. Then, if you determine that actual write-offs last year were $20,000 more than the provision and that the economic conditions for BCS customers has worsened in the current year, explain how you could adjust the allowance.

b. Why is it necessary for BCS to estimate bad debt expense at year-end What accounting principle does BCS violate if it does not estimate bad debt

a. Use this information to calculate a bad debt provision for BCS at December 31, 2010 Last year BCS used the following percentages to calculate the bad debt provision: current accounts, .05%; 30 day accounts, 2%; 60 day accounts, 10%; 90 day accounts, 40%. First calculate the allowance using the percentages applicable in the previous year. Then, if you determine that actual write-offs last year were $20,000 more than the provision and that the economic conditions for BCS customers has worsened in the current year, explain how you could adjust the allowance.

b. Why is it necessary for BCS to estimate bad debt expense at year-end What accounting principle does BCS violate if it does not estimate bad debt

التوضيح

Accounts receivable:

It is the amount d...

Auditing and Assurance Services 1st Edition by Iris Stuart

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255