Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910 تمرين 36

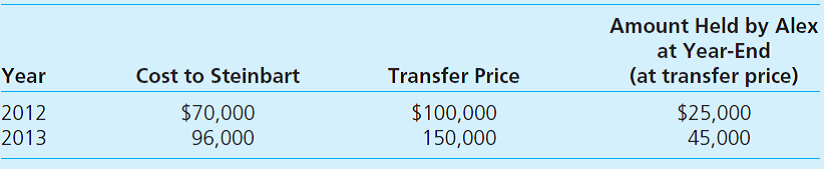

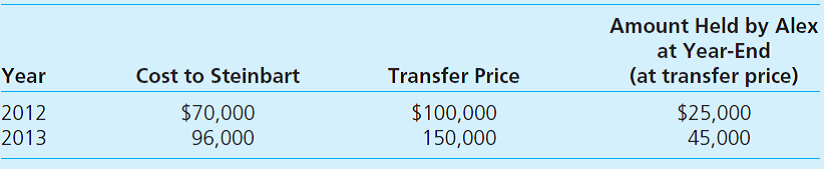

Alex, Inc., buys 40 percent of Steinbart Company on January 1, 2012, for $530,000. The equity method of accounting is to be used. Steinbart's net assets on that date were $1.2 million. Any excess of cost over book value is attributable to a trade name with a 20-year remaining life. Steinbart immediately begins supplying inventory to Alex as follows:

Inventory held at the end of one year by Alex is sold at the beginning of the next.

Steinbart reports net income of $80,000 in 2012 and $110,000 in 2013 while paying $30,000 in dividends each year. What is the equity income in Steinbart to be reported by Alex in 2013

A) $34,050.

B) $38,020.

C) $46,230.

D) $51,450.

Inventory held at the end of one year by Alex is sold at the beginning of the next.

Steinbart reports net income of $80,000 in 2012 and $110,000 in 2013 while paying $30,000 in dividends each year. What is the equity income in Steinbart to be reported by Alex in 2013

A) $34,050.

B) $38,020.

C) $46,230.

D) $51,450.

التوضيح

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255