Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910 تمرين 35

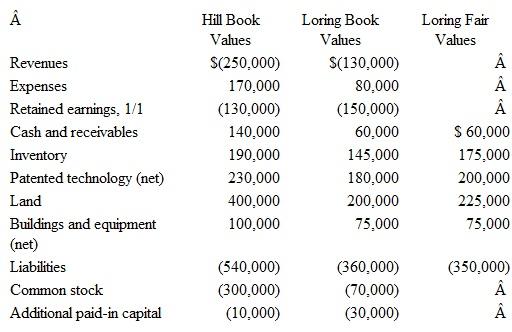

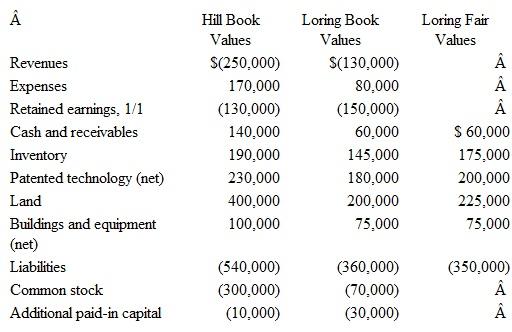

Hill, Inc., obtains control over Loring, Inc., on July 1. The book value and fair value of Loring's accounts on that date (prior to creating the combination) follow, along with the book value of Hill's accounts:

Assume that Hill issues 10,000 shares of common stock with a $5 par value and a $40 fair value to obtain all of Loring's outstanding stock. How much goodwill should be recognized

A) -0-.

B) $15,000.

C) $35,000.

D) $100,000

Assume that Hill issues 10,000 shares of common stock with a $5 par value and a $40 fair value to obtain all of Loring's outstanding stock. How much goodwill should be recognized

A) -0-.

B) $15,000.

C) $35,000.

D) $100,000

التوضيح

Step 1:

Calculate the fair value (FV) of...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255