Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910 تمرين 12

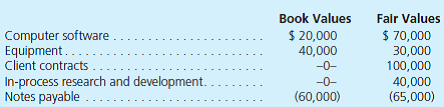

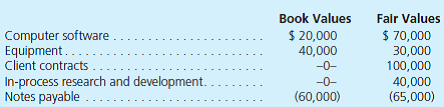

Pratt Company acquired all of Spider, Inc.'s outstanding shares on December 31, 2013, for $495,000 cash. Pratt will operate Spider as a wholly owned subsidiary with a separate legal and accounting identity. Although many of Spider's book values approximate fair values, several of its accounts have fair values that differ from book values. In addition, Spider has internally developed assets that remain unrecorded on its books. In deriving the acquisition price, Pratt assessed Spider's fair and book value differences as follows:

At December 31, 2013, the following financial information is available for consolidation:

Prepare a consolidated balance sheet for Pratt and Spider as of December 31, 2013.

At December 31, 2013, the following financial information is available for consolidation:

Prepare a consolidated balance sheet for Pratt and Spider as of December 31, 2013.

التوضيح

The Income statement is a report which s...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255