Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910 تمرين 18

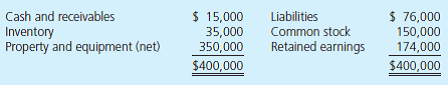

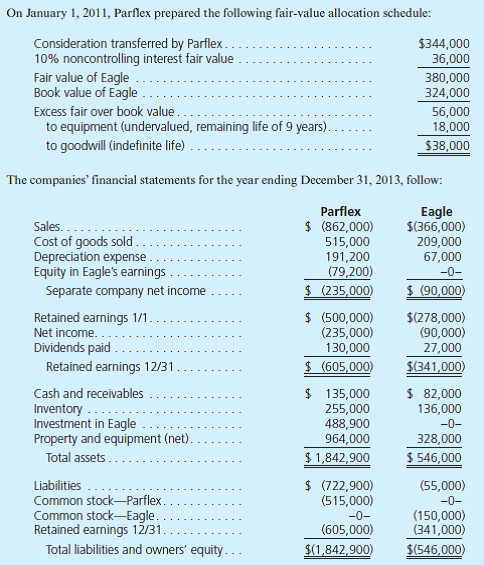

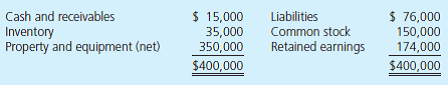

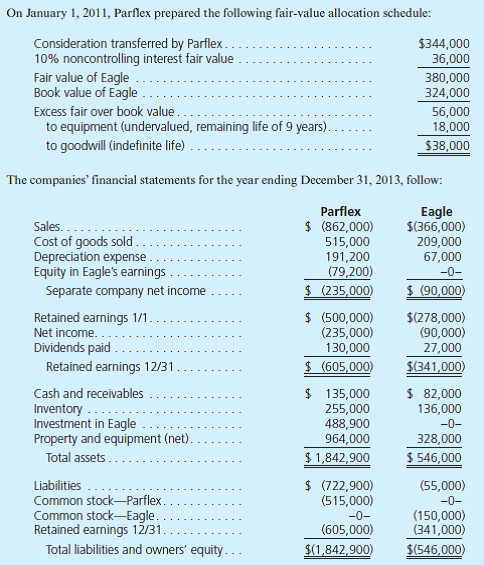

On January 1, 2011, Parflex Corporation exchanged $344,000 cash for 90% of Eagle Corporation's outstanding voting stock. Eagle's acquisition date balance sheet follows:

a. Compute the goodwill allocation to the controlling and noncontrolling interest.

b. Show how Parflex determined its "Investment in Eagle" account balance.

c. Determine the amounts that should appear on Parflex's December 31, 2013, consolidated statement of financial position and its 2013 consolidated income statement.

a. Compute the goodwill allocation to the controlling and noncontrolling interest.

b. Show how Parflex determined its "Investment in Eagle" account balance.

c. Determine the amounts that should appear on Parflex's December 31, 2013, consolidated statement of financial position and its 2013 consolidated income statement.

التوضيح

Noncontrolling inter...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255