Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910 تمرين 49

The Krause Corporation acquired 80 percent of the 100,000 outstanding voting shares of Leahy, Inc., for $6.30 per share on January 1, 2012. The remaining 20 percent of Leahy's shares also traded actively at $6.30 per share before and after Krause's acquisition. An appraisal made on that date determined that all book values appropriately reflected the fair values of Leahy's underlying accounts except that a building with a 5-year life was undervalued by $45,000 and a fully amortized trademark with an estimated 10-year remaining life had a $60,000 fair value.

At the acquisition date, Leahy reported common stock of $100,000 and a retained earnings balance of $280,000.

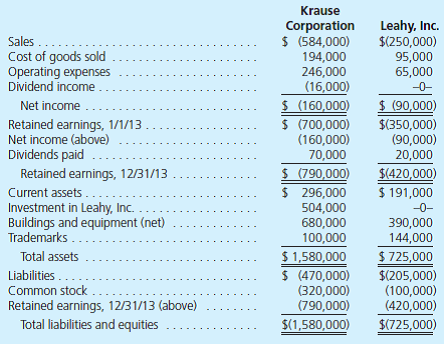

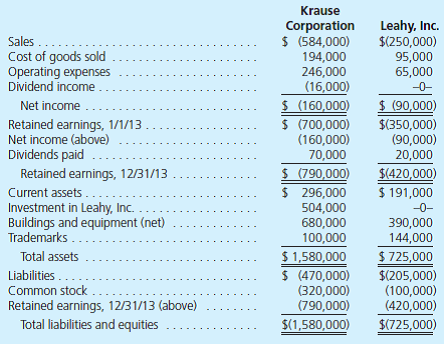

Following are the separate financial statements for the year ending December 31, 2013:

a. Prepare a worksheet to consolidate these two companies as of December 31, 2013.

b. Prepare a 2013 consolidated income statement for Krause and Leahy.

c. If instead the noncontrolling interest shares of Leahy had traded for $4.85 surrounding Krause's acquisition date, how would the consolidated statements change

At the acquisition date, Leahy reported common stock of $100,000 and a retained earnings balance of $280,000.

Following are the separate financial statements for the year ending December 31, 2013:

a. Prepare a worksheet to consolidate these two companies as of December 31, 2013.

b. Prepare a 2013 consolidated income statement for Krause and Leahy.

c. If instead the noncontrolling interest shares of Leahy had traded for $4.85 surrounding Krause's acquisition date, how would the consolidated statements change

التوضيح

"Consolidated Financial Statement:"

"The...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255