Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910 تمرين 53

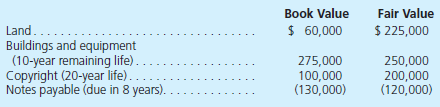

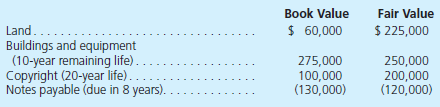

Father, Inc., buys 80 percent of the outstanding common stock of Sam Corporation on January 1, 2013, for $680,000 cash. At the acquisition date, Sam's total fair value, including the noncontrolling interest, was assessed at $850,000 although Sam's book value was only $600,000. Also, several individual items on Sam's financial records had fair values that differed from their book values as follows:

For internal reporting purposes, Father, Inc., employs the equity method to account for this investment.

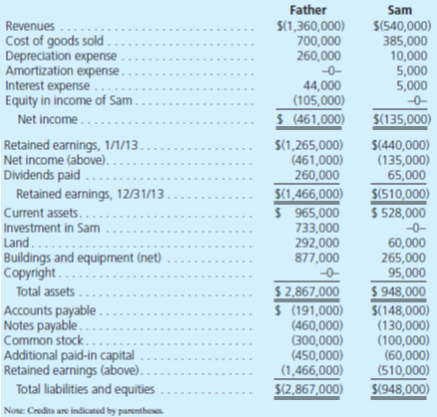

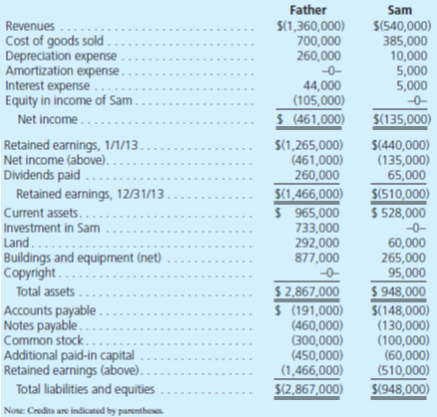

The following account balances are for the year ending December 31, 2013, for both companies.

Using the acquisition method, determine consolidated balances for this business combination (through either individual computations or the use of a worksheet).

For internal reporting purposes, Father, Inc., employs the equity method to account for this investment.

The following account balances are for the year ending December 31, 2013, for both companies.

Using the acquisition method, determine consolidated balances for this business combination (through either individual computations or the use of a worksheet).

التوضيح

"Consolidated Financial Statement:"

"The...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255