Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910 تمرين 38

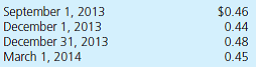

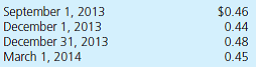

Benjamin, Inc., operates an export/import business. The company has considerable dealings with companies in the country of Camerrand. The denomination of all transactions with these companies is alaries (AL), the Camerrand currency. During 2013, Benjamin acquires 20,000 widgets at a price of 8 alaries per widget. It will pay for them when it sells them. Currency exchange rates for 1 AL are as follows:

a. Assume that Benjamin acquired the widgets on December 1, 2013, and made payment on March 1, 2014. What is the effect of the exchange rate fluctuations on reported income in 2013 and in 2014

b. Assume that Benjamin acquired the widgets on September 1, 2013, and made payment on December 1, 2013. What is the effect of the exchange rate fluctuations on reported income in 2013

c. Assume that Benjamin acquired the widgets on September 1, 2013, and made payment on March 1, 2014. What is the effect of the exchange rate fluctuations on reported income in 2013 and in 2014

a. Assume that Benjamin acquired the widgets on December 1, 2013, and made payment on March 1, 2014. What is the effect of the exchange rate fluctuations on reported income in 2013 and in 2014

b. Assume that Benjamin acquired the widgets on September 1, 2013, and made payment on December 1, 2013. What is the effect of the exchange rate fluctuations on reported income in 2013

c. Assume that Benjamin acquired the widgets on September 1, 2013, and made payment on March 1, 2014. What is the effect of the exchange rate fluctuations on reported income in 2013 and in 2014

التوضيح

"Foreign Currency transaction:"

"In case...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255