Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910 تمرين 52

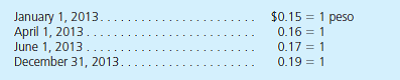

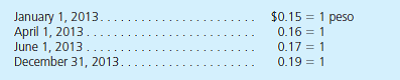

A Clarke Corporation subsidiary buys marketable equity securities and inventory on April 1, 2013, for 100,000 pesos each. It pays for both items on June 1, 2013, and they are still on hand at yearend. Inventory is carried at cost under the lower-of-cost-or-market rule. Currency exchange rates for 1 peso follow:

Assume that the U.S. dollar is the subsidiary's functional currency. What balances does a consolidated balance sheet report as of December 31, 2013

a. Marketable equity securities 5 $16,000 and Inventory 5 $16,000.

b. Marketable equity securities 5 $17,000 and Inventory 5 $17,000.

c. Marketable equity securities 5 $19,000 and Inventory 5 $16,000.

d. Marketable equity securities 5 $19,000 and Inventory 5 $19,000.

Assume that the U.S. dollar is the subsidiary's functional currency. What balances does a consolidated balance sheet report as of December 31, 2013

a. Marketable equity securities 5 $16,000 and Inventory 5 $16,000.

b. Marketable equity securities 5 $17,000 and Inventory 5 $17,000.

c. Marketable equity securities 5 $19,000 and Inventory 5 $16,000.

d. Marketable equity securities 5 $19,000 and Inventory 5 $19,000.

التوضيح

IAS 21 states that every foreign subsidi...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255