Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910 تمرين 6

Watson Company has a subsidiary in the country of Alonza where the local currency unit is the kamel (KM). On December 31, 2012, the subsidiary has the following balance sheet:

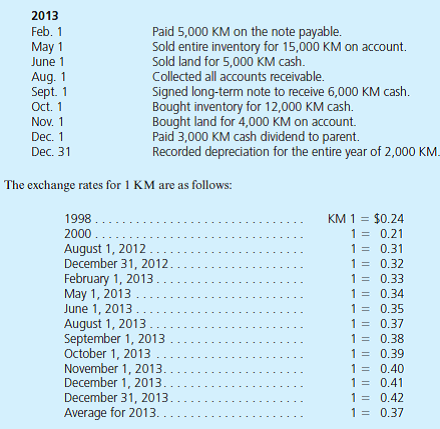

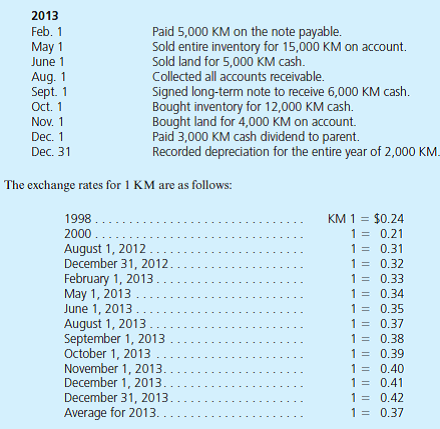

The subsidiary acquired the inventory on August 1, 2012, and the land and buildings in 2000. It issued the common stock in 1998. During 2013, the following transactions took place:

a. If this is a translation, what is the translation adjustment determined solely for 2013

b. If this is a remeasurement, what is the remeasurement gain or loss determined solely for 2013

The subsidiary acquired the inventory on August 1, 2012, and the land and buildings in 2000. It issued the common stock in 1998. During 2013, the following transactions took place:

a. If this is a translation, what is the translation adjustment determined solely for 2013

b. If this is a remeasurement, what is the remeasurement gain or loss determined solely for 2013

التوضيح

"Foreign Currency transaction:"

"In case...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255