Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910 تمرين 2

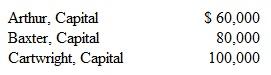

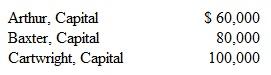

A partnership begins its first year with the following capital balances:

The articles of partnership stipulate that profits and losses be assigned in the following manner:

• Each partner is allocated interest equal to 10 percent of the beginning capital balance.

• Baxter is allocated compensation of $20,000 per year.

• Any remaining profits and losses are allocated on a 3:3:4 basis, respectively.

• Each partner is allowed to withdraw up to $5,000 cash per year.

Assuming that the net income is $50,000 and that each partner withdraws the maximum amount allowed, what is the balance in Cartwright's capital account at the end of that year

a. $105,800.

b. $106,200.

c. $106,900.

d. $107,400.

The articles of partnership stipulate that profits and losses be assigned in the following manner:

• Each partner is allocated interest equal to 10 percent of the beginning capital balance.

• Baxter is allocated compensation of $20,000 per year.

• Any remaining profits and losses are allocated on a 3:3:4 basis, respectively.

• Each partner is allowed to withdraw up to $5,000 cash per year.

Assuming that the net income is $50,000 and that each partner withdraws the maximum amount allowed, what is the balance in Cartwright's capital account at the end of that year

a. $105,800.

b. $106,200.

c. $106,900.

d. $107,400.

التوضيح

Given information:

Arthur capital $60,00...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255