Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910 تمرين 28

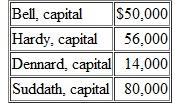

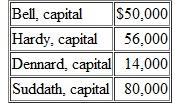

A local partnership is considering possible liquidation because one of the partners (Bell) is insolvent. Capital balances at the current time are as follows. Profits and losses are divided on a 4:3:2:1 basis, respectively.

Bell's creditors have filed a $21,000 claim against the partnership's assets. The partnership currently holds assets reported at $300,000 and liabilities of $100,000. If the assets can be sold for $190,000, what is the minimum amount that Bell's creditors would receive

a. -0 -

b. $2,000.

c. $2,800.

d. $6,000.

Bell's creditors have filed a $21,000 claim against the partnership's assets. The partnership currently holds assets reported at $300,000 and liabilities of $100,000. If the assets can be sold for $190,000, what is the minimum amount that Bell's creditors would receive

a. -0 -

b. $2,000.

c. $2,800.

d. $6,000.

التوضيح

Partnership accounting:

Partnership acc...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255