Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910 تمرين 29

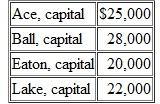

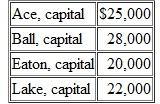

A partnership currently holds three assets: cash, $10,000; land, $35,000; and a building, $50,000. The partners anticipate that expenses required to liquidate their partnership will amount to $5,000. Capital balances are as follows:

The partners share profits and losses as follows: Ace (30%), Ball (30%), Eaton (20%), and Lake (20%). If a preliminary distribution of cash is to be made, how much will each partner receive

The partners share profits and losses as follows: Ace (30%), Ball (30%), Eaton (20%), and Lake (20%). If a preliminary distribution of cash is to be made, how much will each partner receive

التوضيح

Given data can be summarized as below:

...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255