Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

النسخة 5الرقم المعياري الدولي: 978-1260575910 تمرين 24

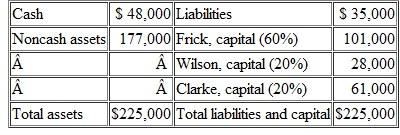

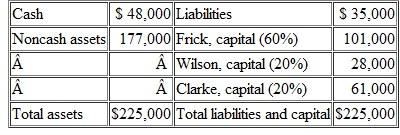

The partnership of Frick, Wilson, and Clarke has elected to cease all operations and liqiuidate its business property. A balance sheet drawn up at this time shows the following account balances:

The following transactions occur in liquidating this business:

• Distributed safe capital balances immediately to the partners. Liquidation expenses of $9,000 are estimated as a basis for this computation.

• Sold noncash assets with a book value of $80,000 for $48,000.

• Paid all liabilities.

• Distributed safe capital balances again.

• Sold remaining noncash assets for $44,000.

• Paid liquidation expenses of $7,000.

• Distributed remaining cash to the partners and closed the financial records of the business permanently.

Produce a final schedule of liquidation for this partnership.

The following transactions occur in liquidating this business:

• Distributed safe capital balances immediately to the partners. Liquidation expenses of $9,000 are estimated as a basis for this computation.

• Sold noncash assets with a book value of $80,000 for $48,000.

• Paid all liabilities.

• Distributed safe capital balances again.

• Sold remaining noncash assets for $44,000.

• Paid liquidation expenses of $7,000.

• Distributed remaining cash to the partners and closed the financial records of the business permanently.

Produce a final schedule of liquidation for this partnership.

التوضيح

Liquidation of partnership:

If a partne...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255