Marketing 4th Edition by Dhruv Grewal,Michael Levy

النسخة 4الرقم المعياري الدولي: 978-0077861025

Marketing 4th Edition by Dhruv Grewal,Michael Levy

النسخة 4الرقم المعياري الدولي: 978-0077861025 تمرين 5

PRICE WARS IN THE CELLULAR MARKET

Cell phone companies may already have all the available customers. Cellular subscriptions have nearly topped 322 million in the United States-a rate equal to 102 percent of the population. That is, there are more cellular subscriptions than there are people in the United States. Examining how cell phone companies like Verizon Wireless, AT T, Sprint, and T-Mobile grow once they've run out of potential customers provides a glimpse into the value of strategic pricing.

THE PLAYERS

With 108.7 million subscribers, Verizon leads the pack. The company is a joint venture of Verizon Communications and Vodafone. In addition to cellular phone service, it offers broadband capability through its wireless network, which was the first broadband network available in the United States. Verizon not only boasted the first wireless consumer 3G multimedia service, but today it also hosts the largest 4G LTE network. Furthermore, its international presence spreads across 195 countries, and it provides business solutions to all the firms listed in the Fortune 500.

AT T traces its roots back to 1876 and Alexander Graham Bell's discovery of the telephone. Although it lags behind Verizon in number of subscribers (100.7 million), it earns more revenue. It also claims to have the fastest mobile broadband

network, whose speed is increasing through 4G technology. Moreover, AT T promises the widest international wireless coverage that offers 99.999 percent reliability. With its WiFi network, the company again claims to be the largest international coverage of any U.S. wireless carrier.

Sprint Nextel holds third place with approximately 55 million customers. The company's most recent innovation is its leading development of the first wireless 4G service. The company merged with Nextel to provide walkie-talkie service in 2004, but running separate networks through the 2G Nextel service and the 3G and 4G Sprint lines has been expensive. Sprint thus plans to decommission its Nextel services by the end of 2013.

T-Mobile USA is owned by Deutsch Telecom and was the subject of several acquisition attempts by competitors, including AT T and Sprint, throughout 2011 and 2012. With 33.8 million subscribers, T-Mobile relies on its global partner to ensure worldwide coverage. In addition it is a member of the Open Handset Alliance, a collaboration designed to develop the Android platform and provide innovative mobile services more quickly.

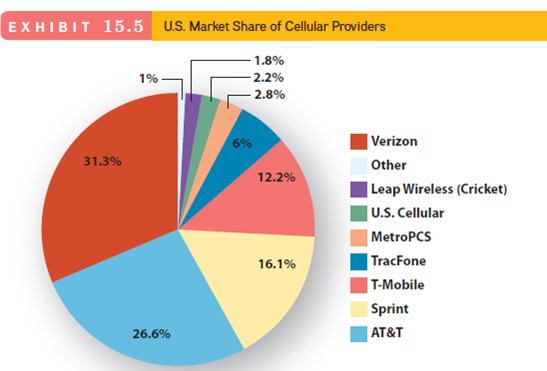

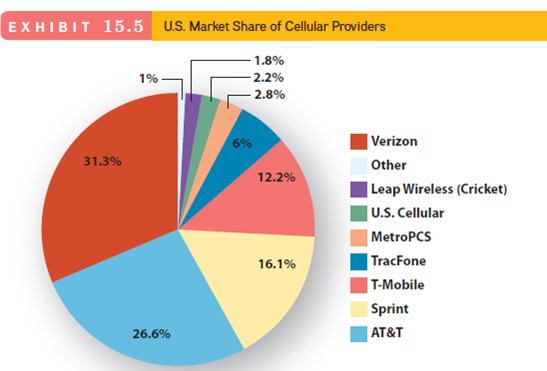

MARKET SHARES AND PRICE WARS

As the cost of cell service has continued to decline, customers' bills have remained flat. Increasing prices is not an option for building revenue in this market. With no new customers to attract, the major phone companies have sought instead to increase their share of the market. Accomplishing that goal has meant competing ferociously to attract customers from competitors. But if the companies tried to lure subscribers with reduced rates, they ran the very real risk of causing harm to their economic bottom line. At the same time, the players could not afford to sit on their hands and do nothing, especially as consumers gave up their home phones, leading to contraction in the landline businesses.

The tactics the competitors use are constantly changing. Let's consider what happened at the introduction of 4G services. Verizon offered a data rate of $50 per month for 5GB of usage on the 4G network-less expensive than its $60\month rate for 3G services. Sprint priced its services at $60 per month for unlimited 4G data usage and 5GB of 3G usage. Initially though, 4G coverage has not been universal, which means that customers often wind up reverting to more 3G usage. Thus the best option for each customer depends largely on how much data he or she plans to use each month, which remains a difficult estimate for most users.

Although it may seem as though everyone is using advanced data plans on smartphones and tablets, there remains a market for voice-only options as well. Verizon Wireless cut prices for its unlimited talk and unlimited talk text plans. The company also lowered costs for its family share plans. AT T promptly matched Verizon's changes. T-Mobile already had an unlimited talk plan for $60, $10 less than the new prices at AT T and Verizon. Sprint can claim that its "Everything Data" plans already were cheaper than Verizon's, saving individual users as much as $240 per year and families almost $600.

The goal of cost cuts on voice plans, according to Verizon Wireless's CEO Lowell McAdam, is to get customers enrolled in more expensive unlimited plans, especially for data. Capturing market share from competitors is also important, but it does not offer the same value in terms of generating revenue. Verizon Wireless, for example, may give up $540 million in voice revenue but experience a net gain of $90 million because of changes in data plan sales and because of the healthier margins associated with data plans.

Networks account for only a piece of a wireless company's revenue stream. To access voice, text, or data services, customers need handsets, which are becoming increasingly more sophisticated. But here again, companies are cutting prices on handsets in an effort to attract market share. Suppliers of Apple devices sometimes sell the iPhones for $200 less than they have paid Apple for them, just to lure subscribers to its two-year plans.

The war is far from over, especially in such a rapidly changing, frequently innovating market. Increased broadband use has challenged overburdened networks, and cell phone companies may be forced to invest in their networks to avoid service failures and customer complaints. If voice plans drop further, revenue from data plans may no longer provide the margins cell phone companies need. Some wireless providers may consolidate; others will fade away. What pricing tactics could Verizon use to target business customers

Cell phone companies may already have all the available customers. Cellular subscriptions have nearly topped 322 million in the United States-a rate equal to 102 percent of the population. That is, there are more cellular subscriptions than there are people in the United States. Examining how cell phone companies like Verizon Wireless, AT T, Sprint, and T-Mobile grow once they've run out of potential customers provides a glimpse into the value of strategic pricing.

THE PLAYERS

With 108.7 million subscribers, Verizon leads the pack. The company is a joint venture of Verizon Communications and Vodafone. In addition to cellular phone service, it offers broadband capability through its wireless network, which was the first broadband network available in the United States. Verizon not only boasted the first wireless consumer 3G multimedia service, but today it also hosts the largest 4G LTE network. Furthermore, its international presence spreads across 195 countries, and it provides business solutions to all the firms listed in the Fortune 500.

AT T traces its roots back to 1876 and Alexander Graham Bell's discovery of the telephone. Although it lags behind Verizon in number of subscribers (100.7 million), it earns more revenue. It also claims to have the fastest mobile broadband

network, whose speed is increasing through 4G technology. Moreover, AT T promises the widest international wireless coverage that offers 99.999 percent reliability. With its WiFi network, the company again claims to be the largest international coverage of any U.S. wireless carrier.

Sprint Nextel holds third place with approximately 55 million customers. The company's most recent innovation is its leading development of the first wireless 4G service. The company merged with Nextel to provide walkie-talkie service in 2004, but running separate networks through the 2G Nextel service and the 3G and 4G Sprint lines has been expensive. Sprint thus plans to decommission its Nextel services by the end of 2013.

T-Mobile USA is owned by Deutsch Telecom and was the subject of several acquisition attempts by competitors, including AT T and Sprint, throughout 2011 and 2012. With 33.8 million subscribers, T-Mobile relies on its global partner to ensure worldwide coverage. In addition it is a member of the Open Handset Alliance, a collaboration designed to develop the Android platform and provide innovative mobile services more quickly.

MARKET SHARES AND PRICE WARS

As the cost of cell service has continued to decline, customers' bills have remained flat. Increasing prices is not an option for building revenue in this market. With no new customers to attract, the major phone companies have sought instead to increase their share of the market. Accomplishing that goal has meant competing ferociously to attract customers from competitors. But if the companies tried to lure subscribers with reduced rates, they ran the very real risk of causing harm to their economic bottom line. At the same time, the players could not afford to sit on their hands and do nothing, especially as consumers gave up their home phones, leading to contraction in the landline businesses.

The tactics the competitors use are constantly changing. Let's consider what happened at the introduction of 4G services. Verizon offered a data rate of $50 per month for 5GB of usage on the 4G network-less expensive than its $60\month rate for 3G services. Sprint priced its services at $60 per month for unlimited 4G data usage and 5GB of 3G usage. Initially though, 4G coverage has not been universal, which means that customers often wind up reverting to more 3G usage. Thus the best option for each customer depends largely on how much data he or she plans to use each month, which remains a difficult estimate for most users.

Although it may seem as though everyone is using advanced data plans on smartphones and tablets, there remains a market for voice-only options as well. Verizon Wireless cut prices for its unlimited talk and unlimited talk text plans. The company also lowered costs for its family share plans. AT T promptly matched Verizon's changes. T-Mobile already had an unlimited talk plan for $60, $10 less than the new prices at AT T and Verizon. Sprint can claim that its "Everything Data" plans already were cheaper than Verizon's, saving individual users as much as $240 per year and families almost $600.

The goal of cost cuts on voice plans, according to Verizon Wireless's CEO Lowell McAdam, is to get customers enrolled in more expensive unlimited plans, especially for data. Capturing market share from competitors is also important, but it does not offer the same value in terms of generating revenue. Verizon Wireless, for example, may give up $540 million in voice revenue but experience a net gain of $90 million because of changes in data plan sales and because of the healthier margins associated with data plans.

Networks account for only a piece of a wireless company's revenue stream. To access voice, text, or data services, customers need handsets, which are becoming increasingly more sophisticated. But here again, companies are cutting prices on handsets in an effort to attract market share. Suppliers of Apple devices sometimes sell the iPhones for $200 less than they have paid Apple for them, just to lure subscribers to its two-year plans.

The war is far from over, especially in such a rapidly changing, frequently innovating market. Increased broadband use has challenged overburdened networks, and cell phone companies may be forced to invest in their networks to avoid service failures and customer complaints. If voice plans drop further, revenue from data plans may no longer provide the margins cell phone companies need. Some wireless providers may consolidate; others will fade away. What pricing tactics could Verizon use to target business customers

التوضيح

Business-to-business pricing tactics:

T...

Marketing 4th Edition by Dhruv Grewal,Michael Levy

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255