International Economics 8th Edition by Dennis Appleyard, Alfred Field

النسخة 8الرقم المعياري الدولي: 9780078021671

International Economics 8th Edition by Dennis Appleyard, Alfred Field

النسخة 8الرقم المعياري الدولي: 9780078021671 تمرين 3

Suppose that both the supply curve of imports to country A and the supply curve of exports from country A are horizontal (as in Figure). Assume that at a predepreciation value of A's currency, country A sells 975 units of exports and purchases 810 units of imports. (You do not need to know the actual prices of imports and exports, but assume that trade is initially balanced.) Suppose now that there is a 10 percent depreciation of A's currency against foreign currencies and that because of the depreciation exports rise to 1,025 units and imports fall to 790 units. Would the simple Marshall- Lerner condition suggest that country A's current account balance has improved or deteriorated because of this depreciation of its currency? Explain carefully.

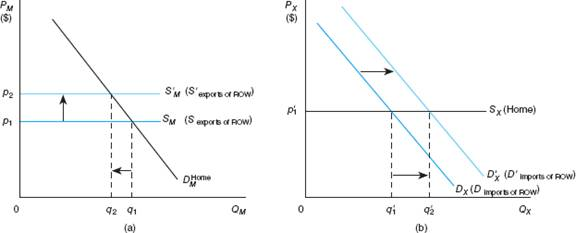

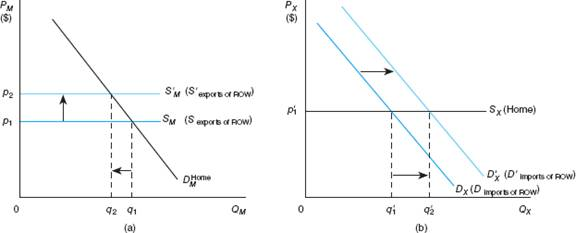

FIGURE Market Effects of a Change in the Foreign Exchange Rate

Assuming that the supply of exports is infinitely elastic in both countries (i.e., the supply curve of imports and the supply curve of exports in the home country are horizontal), a depreciation of the home currency leads to (1) an upward shift in the supply curve of imports from S M to S? M (due to the higher domestic price of imports in the home currency) and (2) a rightward shift in the demand for exports from D X to D? X (because the foreign currency price of home-country exports as fallen relatively). The effect of the depreciation on the value of imports depends on the elasticity of the demand for imports. Given that import outlays before the depreciation were p 1 q 1 and after the depreciation are p 2 q 2 , the depreciation reduces import outlays only if import demand is elastic. If demand is inelastic, the value of import outlays in dollar terms actually rises. The value of export receipts increases unambiguously because a larger quantity q? 2 than the original q? 1 is purchased at a constant-dollar price. The ultimate impact of depreciation on the current account balance thus depends on the sum of these two effects and can be positive or negative depending on the elasticity of demand in each country for the other country's goods and services.

FIGURE Market Effects of a Change in the Foreign Exchange Rate

Assuming that the supply of exports is infinitely elastic in both countries (i.e., the supply curve of imports and the supply curve of exports in the home country are horizontal), a depreciation of the home currency leads to (1) an upward shift in the supply curve of imports from S M to S? M (due to the higher domestic price of imports in the home currency) and (2) a rightward shift in the demand for exports from D X to D? X (because the foreign currency price of home-country exports as fallen relatively). The effect of the depreciation on the value of imports depends on the elasticity of the demand for imports. Given that import outlays before the depreciation were p 1 q 1 and after the depreciation are p 2 q 2 , the depreciation reduces import outlays only if import demand is elastic. If demand is inelastic, the value of import outlays in dollar terms actually rises. The value of export receipts increases unambiguously because a larger quantity q? 2 than the original q? 1 is purchased at a constant-dollar price. The ultimate impact of depreciation on the current account balance thus depends on the sum of these two effects and can be positive or negative depending on the elasticity of demand in each country for the other country's goods and services.

التوضيح

Current account balance depends on the c...

International Economics 8th Edition by Dennis Appleyard, Alfred Field

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255