Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

النسخة 6الرقم المعياري الدولي: 978-1305103962

Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

النسخة 6الرقم المعياري الدولي: 978-1305103962 تمرين 43

Basic Break-Even Calculations

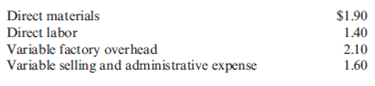

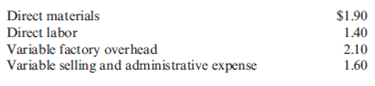

Suppose that Adams Company sells a product for $20. Unit costs are as follows:

Total fixed factory overhead is $54,420 per year, and total fixed selling and administrative expense is $38,530.

Required:

1. Calculate the variable cost per unit and the contribution margin per unit.

2. Calculate the contribution margin ratio and the variable cost ratio.

3. Calculate the break-even units.

4. Prepare a contribution margin income statement at the break-even number of units.

Suppose that Adams Company sells a product for $20. Unit costs are as follows:

Total fixed factory overhead is $54,420 per year, and total fixed selling and administrative expense is $38,530.

Required:

1. Calculate the variable cost per unit and the contribution margin per unit.

2. Calculate the contribution margin ratio and the variable cost ratio.

3. Calculate the break-even units.

4. Prepare a contribution margin income statement at the break-even number of units.

التوضيح

By extracting the information :

Part ...

Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255