Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

النسخة 6الرقم المعياري الدولي: 978-1305103962

Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

النسخة 6الرقم المعياري الدولي: 978-1305103962 تمرين 34

Net Present Value versus Internal Rate of Return

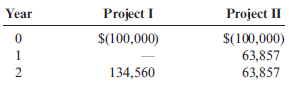

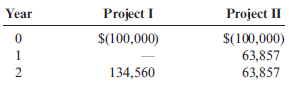

Skiba Company is thinking about two different modifications to its current manufacturing process. The after-tax cash flows associated with the two investments follow:

Skiba's cost of capital is 10%.

Required:

1. Compute the NPV and the IRR for each investment.

2. CONCEPTUAL CONNECTION Explain why the project with the larger NPV is the correct choice for Skiba.

Skiba Company is thinking about two different modifications to its current manufacturing process. The after-tax cash flows associated with the two investments follow:

Skiba's cost of capital is 10%.

Required:

1. Compute the NPV and the IRR for each investment.

2. CONCEPTUAL CONNECTION Explain why the project with the larger NPV is the correct choice for Skiba.

التوضيح

Techniques like Pay-back period, NPV, AR...

Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255