Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

النسخة 6الرقم المعياري الدولي: 978-1305103962

Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

النسخة 6الرقم المعياري الدولي: 978-1305103962 تمرين 15

Discount Rates, Automated Manufacturing, Competing Investments

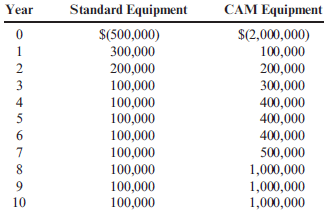

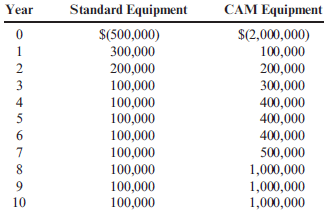

Patterson Company is considering two competing investments. The first is for a standard piece of production equipment. The second is for computer-aided manufacturing (CAM) equipment. The investment and after-tax operating cash flows follow:

Patterson uses a discount rate of 18% for all of its investments. Patterson's cost of capital is 10%.

Required:

1. Calculate the NPV for each investment by using a discount rate of 18%.

2. Calculate the NPV for each investment by using a discount rate of 10%.

3. CONCEPTUAL CONNECTION Which rate should Patterson use to compute the NPV? Explain.

Patterson Company is considering two competing investments. The first is for a standard piece of production equipment. The second is for computer-aided manufacturing (CAM) equipment. The investment and after-tax operating cash flows follow:

Patterson uses a discount rate of 18% for all of its investments. Patterson's cost of capital is 10%.

Required:

1. Calculate the NPV for each investment by using a discount rate of 18%.

2. Calculate the NPV for each investment by using a discount rate of 10%.

3. CONCEPTUAL CONNECTION Which rate should Patterson use to compute the NPV? Explain.

التوضيح

Capital invest involves huge investment....

Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255