Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

النسخة 26الرقم المعياري الدولي: 978-1337498159

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

النسخة 26الرقم المعياري الدولي: 978-1337498159 تمرين 43

Financial statements for partnership

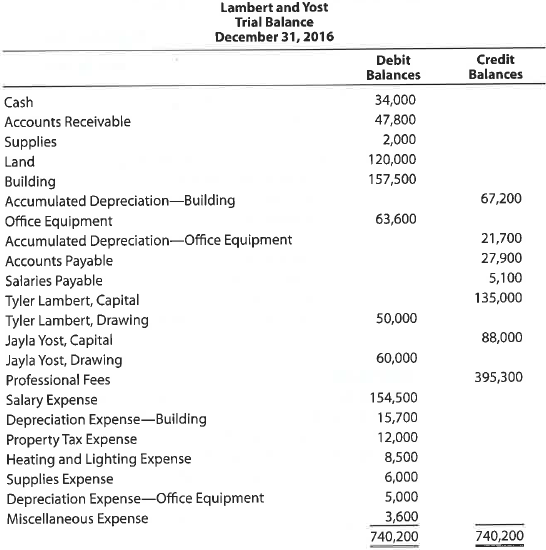

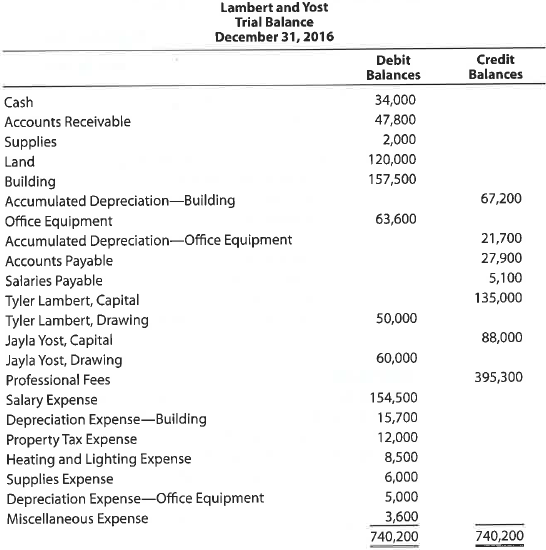

The ledger of Tyler Lambert and Jayla Yost, attorneys-at-law, contains the following accounts and balances after adjustments have been recorded on December 31, 2016:

The balance in Yost's capital account includes an additional investment of $10,000 made on April 10, 2016.

Instructions

1. Prepare an income statement for 2016, indicating the division of net income. The partnership agreement provides for salary allowances of $45,000 to Lambert and $54,700 to Yost, allowances of 10% on each partner's capital balance at the beginning of the fiscal year, and equal division of the remaining net income or net loss.

2. Prepare a statement of partnership equity for 2016.

3. Prepare a balance sheet as of the end of 2016.

The ledger of Tyler Lambert and Jayla Yost, attorneys-at-law, contains the following accounts and balances after adjustments have been recorded on December 31, 2016:

The balance in Yost's capital account includes an additional investment of $10,000 made on April 10, 2016.

Instructions

1. Prepare an income statement for 2016, indicating the division of net income. The partnership agreement provides for salary allowances of $45,000 to Lambert and $54,700 to Yost, allowances of 10% on each partner's capital balance at the beginning of the fiscal year, and equal division of the remaining net income or net loss.

2. Prepare a statement of partnership equity for 2016.

3. Prepare a balance sheet as of the end of 2016.

التوضيح

1.Prepare an income statement for 2016: ...

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255