Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

النسخة 26الرقم المعياري الدولي: 978-1337498159

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

النسخة 26الرقم المعياري الدولي: 978-1337498159 تمرين 10

Admitting new partner

Brian Caldwell and Adriana Estrada have operated a successful firm for many years, sharing net income and net losses equally. Kris Mays is to be admitted to the partnership on September 1 of the current year, in accordance with the following agreement:

a. Assets and liabilities of the old partnership are to be valued at their book values as of August 31, except for the following:

• Accounts receivable amounting to $1,500 are to be written off, and the allowance for doubtful accounts is to be increased to 5% of the remaining accounts.

• Merchandise inventory is to be valued at $46,800.

• Equipment is to be valued at $64,500.

b. Mays is to purchase $26,000 of the ownership interest of Estrada for $30,000 cash and to contribute $32,000 cash to the partnership for a total ownership equity of $58,000.

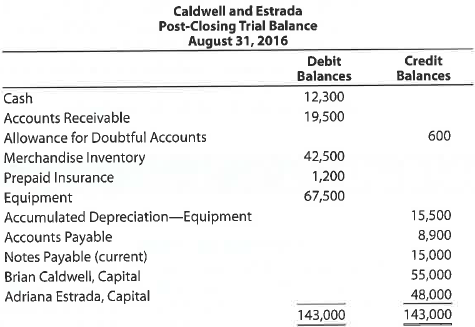

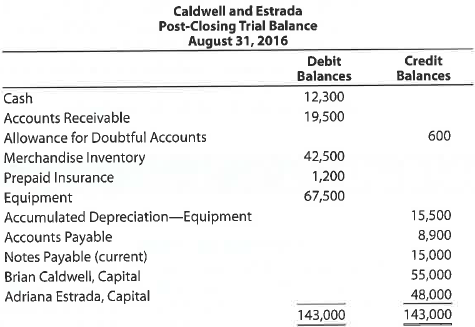

The post-closing trial balance of Caldwell and Estrada as of August 31 follows:

Instructions

1. Journalize the entries as of August 31 to record the revaluations, using a temporary account entitled Asset Revaluations. The balance in the accumulated depreciation account is to be eliminated. After journalizing the revaluations, close the balance of the asset revaluations account to the capital accounts of Brian Caldwell and Adriana Estrada.

2. Journalize the additional entries to record Mays' entrance to the partnership on September 1, 2016.

3. Present a balance sheet for the new partnership as of September 1, 2016.

Brian Caldwell and Adriana Estrada have operated a successful firm for many years, sharing net income and net losses equally. Kris Mays is to be admitted to the partnership on September 1 of the current year, in accordance with the following agreement:

a. Assets and liabilities of the old partnership are to be valued at their book values as of August 31, except for the following:

• Accounts receivable amounting to $1,500 are to be written off, and the allowance for doubtful accounts is to be increased to 5% of the remaining accounts.

• Merchandise inventory is to be valued at $46,800.

• Equipment is to be valued at $64,500.

b. Mays is to purchase $26,000 of the ownership interest of Estrada for $30,000 cash and to contribute $32,000 cash to the partnership for a total ownership equity of $58,000.

The post-closing trial balance of Caldwell and Estrada as of August 31 follows:

Instructions

1. Journalize the entries as of August 31 to record the revaluations, using a temporary account entitled Asset Revaluations. The balance in the accumulated depreciation account is to be eliminated. After journalizing the revaluations, close the balance of the asset revaluations account to the capital accounts of Brian Caldwell and Adriana Estrada.

2. Journalize the additional entries to record Mays' entrance to the partnership on September 1, 2016.

3. Present a balance sheet for the new partnership as of September 1, 2016.

التوضيح

1.Journalize the entries as of August 31...

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255