Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

النسخة 26الرقم المعياري الدولي: 978-1337498159

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

النسخة 26الرقم المعياري الدولي: 978-1337498159 تمرين 24

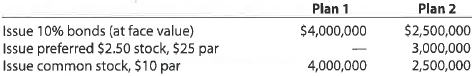

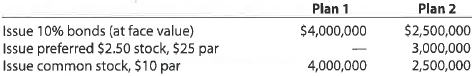

A Alternative financing plans

Owen Co. is considering the following alternative financing plans:

Income tax is estimated at 40% of income.

Determine the earnings per share of common stock, assuming income before bond interest and income tax is $750,000.

B Alternative financing plans

Brower Co. is considering the following alternative financing plans:

Income tax is estimated at 40% of income.

Determine the earnings per share of common stock, assuming income before bond interest and income tax is $2,000,000.

Owen Co. is considering the following alternative financing plans:

Income tax is estimated at 40% of income.

Determine the earnings per share of common stock, assuming income before bond interest and income tax is $750,000.

B Alternative financing plans

Brower Co. is considering the following alternative financing plans:

Income tax is estimated at 40% of income.

Determine the earnings per share of common stock, assuming income before bond interest and income tax is $2,000,000.

التوضيح

1A

Computation of Earnings pe...

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255