Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 51

Recording the Effects of Transactions

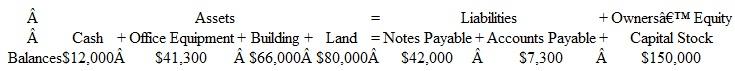

Delta Corporation was organized on December 1 of the current year and had the following account balances at December 31, listed in tabular form:

Early in January, the following transactions were carried out by Delta Corporation:

1. Sold capital stock to owners for $40,000.

2. Purchased land and a small office building for a total price of $80,000, of which $30,000 was the value of the land and $50,000 was the value of the building. Paid $10,000 in cash and signed a note payable for the remaining $70,000.

3. Bought several computer systems on credit for $8,000 (30-day open account).

4. Obtained a loan from 2nd Bank in the amount of $12,000. Signed a note payable.

5. Paid $6,000 of account payable due as of December 31.

Instructions

a. List the December 31 balances of assets, liabilities, and owners' equity in tabular form as shown above.

b. Record the effects of each of the five transactions in the format illustrated in Chapter 2 of the text. Show the totals for all columns after each transaction.

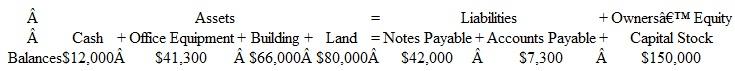

Delta Corporation was organized on December 1 of the current year and had the following account balances at December 31, listed in tabular form:

Early in January, the following transactions were carried out by Delta Corporation:

1. Sold capital stock to owners for $40,000.

2. Purchased land and a small office building for a total price of $80,000, of which $30,000 was the value of the land and $50,000 was the value of the building. Paid $10,000 in cash and signed a note payable for the remaining $70,000.

3. Bought several computer systems on credit for $8,000 (30-day open account).

4. Obtained a loan from 2nd Bank in the amount of $12,000. Signed a note payable.

5. Paid $6,000 of account payable due as of December 31.

Instructions

a. List the December 31 balances of assets, liabilities, and owners' equity in tabular form as shown above.

b. Record the effects of each of the five transactions in the format illustrated in Chapter 2 of the text. Show the totals for all columns after each transaction.

التوضيح

(a b) Listing of December 31 b...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255