Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 6

An Alternate Problem on Recording the Effects of Transactions

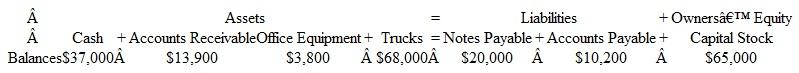

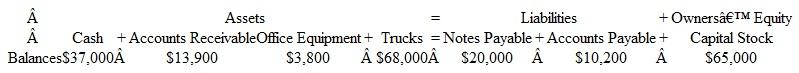

The items making up the balance sheet of Phillips Truck Rental at December 31 are listed below in tabular form similar to the illustration of the accounting equation in Exhibit 2-11.

During a short period after December 31, Phillips Truck Rental had the following transactions:

1. Bought office equipment at a cost of $2,700. Paid cash.

2. Collected $4,000 of accounts receivable.

3. Paid $3,200 of accounts payable.

4. Borrowed $10,000 from a bank. Signed a note payable for that amount.

5. Purchased two trucks for $30,500. Paid $15,000 cash and signed a note payable for the balance.

6. Sold additional stock to investors for $85,000.

Instructions

a. List the December 31 balances of assets, liabilities, and owners' equity in tabular form as shown above.

b. Record the effects of each of the six transactions in the preceding tabular arrangement. Show the totals for all columns after each transaction.

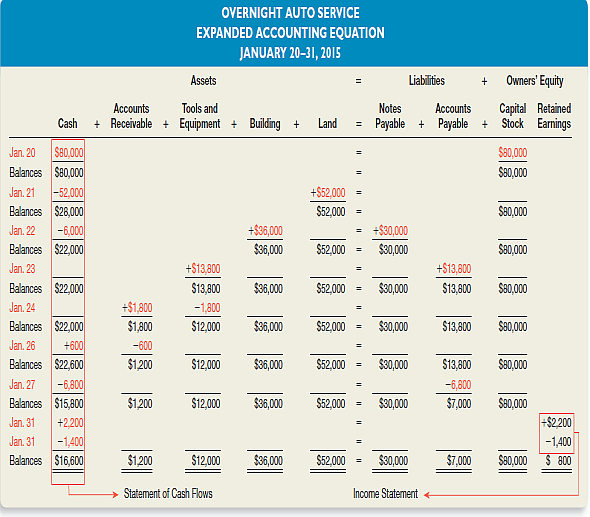

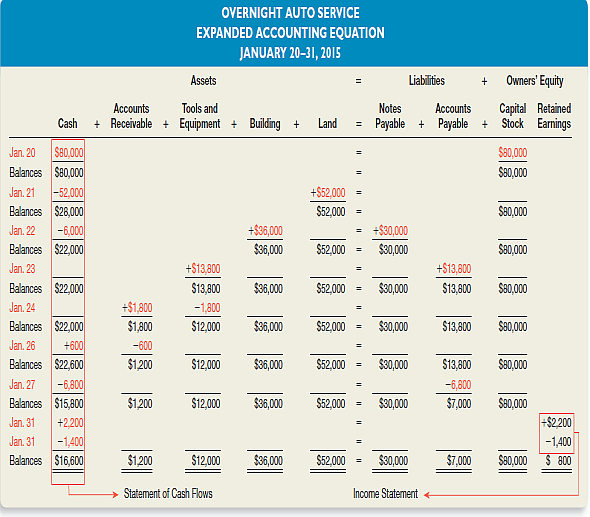

EXHIBIT 2-11 Expanded Accounting Equation

The items making up the balance sheet of Phillips Truck Rental at December 31 are listed below in tabular form similar to the illustration of the accounting equation in Exhibit 2-11.

During a short period after December 31, Phillips Truck Rental had the following transactions:

1. Bought office equipment at a cost of $2,700. Paid cash.

2. Collected $4,000 of accounts receivable.

3. Paid $3,200 of accounts payable.

4. Borrowed $10,000 from a bank. Signed a note payable for that amount.

5. Purchased two trucks for $30,500. Paid $15,000 cash and signed a note payable for the balance.

6. Sold additional stock to investors for $85,000.

Instructions

a. List the December 31 balances of assets, liabilities, and owners' equity in tabular form as shown above.

b. Record the effects of each of the six transactions in the preceding tabular arrangement. Show the totals for all columns after each transaction.

EXHIBIT 2-11 Expanded Accounting Equation

التوضيح

(a b) Listing of December 31 b...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255