Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 52

A number of business transactions carried out by Smalling Manufacturing Company are as follows

a. Borrowed money from a bank.

b. Sold land for cash at a price equal to its cost.

c. Paid a liability.

d. Returned for credit some of the office equipment previously purchased on credit but not yet paid for. (Treat this the opposite of a transaction in which you purchased office equipment on credit.)

e. Sold land for cash at a price in excess of cost. (Hint: The difference between cost and sale; price represents a gain that will be in the company's income statement.)

f. Purchased a computer on credit.

g. The owner invested cash in the business.

h. Purchased office equipment for cash.

i. Collected an account receivable.

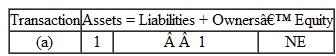

Indicate the effects of each of these transactions on the total amounts of the company's assets, liabilities. and owners' equity. Organize your answer in tabular form, using the following column headings and the code letters I for increase. D for decrease, and NE for no effect. The answer for transaction a is provided as an example:

a. Borrowed money from a bank.

b. Sold land for cash at a price equal to its cost.

c. Paid a liability.

d. Returned for credit some of the office equipment previously purchased on credit but not yet paid for. (Treat this the opposite of a transaction in which you purchased office equipment on credit.)

e. Sold land for cash at a price in excess of cost. (Hint: The difference between cost and sale; price represents a gain that will be in the company's income statement.)

f. Purchased a computer on credit.

g. The owner invested cash in the business.

h. Purchased office equipment for cash.

i. Collected an account receivable.

Indicate the effects of each of these transactions on the total amounts of the company's assets, liabilities. and owners' equity. Organize your answer in tabular form, using the following column headings and the code letters I for increase. D for decrease, and NE for no effect. The answer for transaction a is provided as an example:

التوضيح

Transaction Analysis:

Transaction analy...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255