Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 59

Satka Fishing Expeditions, Inc.. recorded the following transactions in July:

1. Provided an ocean fishing expedition for a credit customer; payment is due August 10.

2. Paid Marine Service Center for repairs to boats performed in June. (In June, Satka Fishing Expeditions, Inc.. had received and properly recorded the invoice for these repairs.)

3. Collected the full amount due from a credit customer for a fishing expedition provided in June.

4. Received a bill from Baldy's Bait Shop for bait purchased and used in July. Payment is due August 3.

5. Purchased a new fishing boat on July 28. paying part cash and issuing a note payable for the balance. The new boat is first scheduled for use on August 5.

6. Declared and paid a cash dividend on July 31.

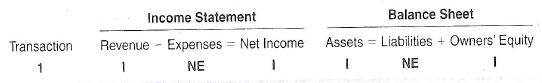

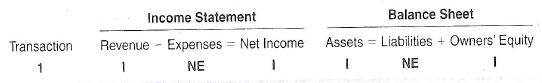

Indicate the effects that each of these transactions will have upon the following six total amounts in the company's financial statements for the month of July. Organize your answer in tabular form, using the column headings shown, and use the code letters I for increase, D for decrease, and NE for no effect. The answer to transcation 1 is provided as an example

1. Provided an ocean fishing expedition for a credit customer; payment is due August 10.

2. Paid Marine Service Center for repairs to boats performed in June. (In June, Satka Fishing Expeditions, Inc.. had received and properly recorded the invoice for these repairs.)

3. Collected the full amount due from a credit customer for a fishing expedition provided in June.

4. Received a bill from Baldy's Bait Shop for bait purchased and used in July. Payment is due August 3.

5. Purchased a new fishing boat on July 28. paying part cash and issuing a note payable for the balance. The new boat is first scheduled for use on August 5.

6. Declared and paid a cash dividend on July 31.

Indicate the effects that each of these transactions will have upon the following six total amounts in the company's financial statements for the month of July. Organize your answer in tabular form, using the column headings shown, and use the code letters I for increase, D for decrease, and NE for no effect. The answer to transcation 1 is provided as an example

التوضيح

Income statement and Balance sheet

Inco...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255