Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 7

Short Comprehensive Problem

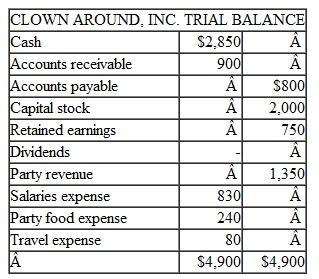

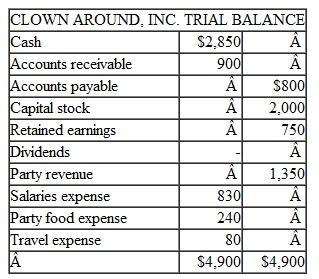

Clown Around, Inc., provides party entertainment for children of all ages. The company's trial balance dated February 1, 2011 , is shown below.

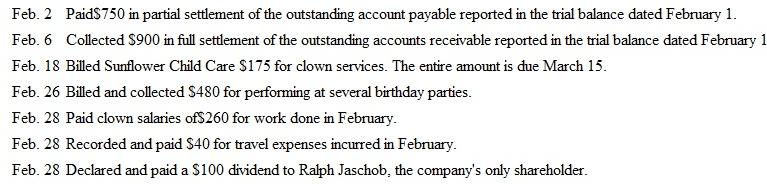

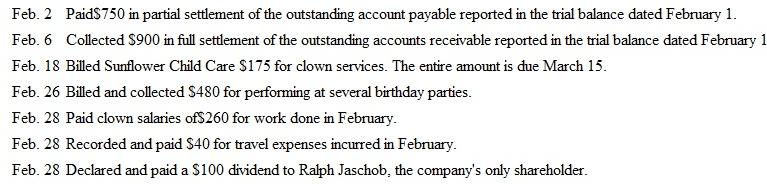

Clown Around engaged in the following transactions in February:

Clown Around engaged in the following transactions in February:

a. Record the company's February transactions in general journal form. Include a brief explanation of the transaction as part of each journal entry.

a. Record the company's February transactions in general journal form. Include a brief explanation of the transaction as part of each journal entry.

b. Post each entry to the appropriate ledger accounts (use the T account format as illustrated in Exhibit 3-8 on page 108).

c. Prepare a trial balance dated February 28, 2011. (Hint: Retained Earnings will be reported at the same amount as it was on February 1. Accounting for changes in the Retained Earnings account resulting from revenue, expense, and dividend activities is discussed in Chapter 5.)

d. Will the $100 dividend paid February 28 decrease the company's income? Explain.

Clown Around, Inc., provides party entertainment for children of all ages. The company's trial balance dated February 1, 2011 , is shown below.

Clown Around engaged in the following transactions in February:

Clown Around engaged in the following transactions in February: a. Record the company's February transactions in general journal form. Include a brief explanation of the transaction as part of each journal entry.

a. Record the company's February transactions in general journal form. Include a brief explanation of the transaction as part of each journal entry.b. Post each entry to the appropriate ledger accounts (use the T account format as illustrated in Exhibit 3-8 on page 108).

c. Prepare a trial balance dated February 28, 2011. (Hint: Retained Earnings will be reported at the same amount as it was on February 1. Accounting for changes in the Retained Earnings account resulting from revenue, expense, and dividend activities is discussed in Chapter 5.)

d. Will the $100 dividend paid February 28 decrease the company's income? Explain.

التوضيح

b. Ledger Accounts:

...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255