Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 2

Interim Financial Statements

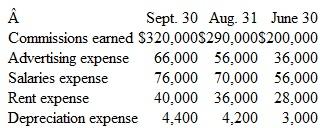

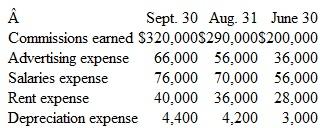

Howard Realty adjusts its accounts monthly but closes them only at the end of the calendar year. Below are the adjusted balances of the revenue and expense accounts at September 30 of the current year and at the ends of two earlier months:

Instructions

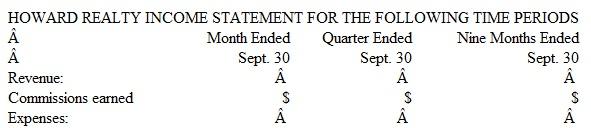

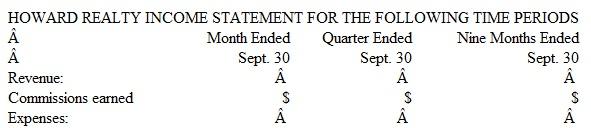

a. Prepare a three-column income statement, showing net income for three separate time periods, all of which end on September 30. Use the format illustrated below. Show supporting computations for the amounts of revenue in the first two columns.

b. Briefly explain how you determined the dollar amounts for each of the three time periods. Would you apply the same process to the balances in Howard's balance sheet accounts? Explain.

c. Assume that Howard adjusts and closes its accounts at the end of each month. Briefly explain how you then would determine the revenue and expenses that would appear in each of the three columns of the income statement prepared in part a.

Howard Realty adjusts its accounts monthly but closes them only at the end of the calendar year. Below are the adjusted balances of the revenue and expense accounts at September 30 of the current year and at the ends of two earlier months:

Instructions

a. Prepare a three-column income statement, showing net income for three separate time periods, all of which end on September 30. Use the format illustrated below. Show supporting computations for the amounts of revenue in the first two columns.

b. Briefly explain how you determined the dollar amounts for each of the three time periods. Would you apply the same process to the balances in Howard's balance sheet accounts? Explain.

c. Assume that Howard adjusts and closes its accounts at the end of each month. Briefly explain how you then would determine the revenue and expenses that would appear in each of the three columns of the income statement prepared in part a.

التوضيح

(a)

Adjusting entries change the balance...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255