Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 39

Evaluating Profitability

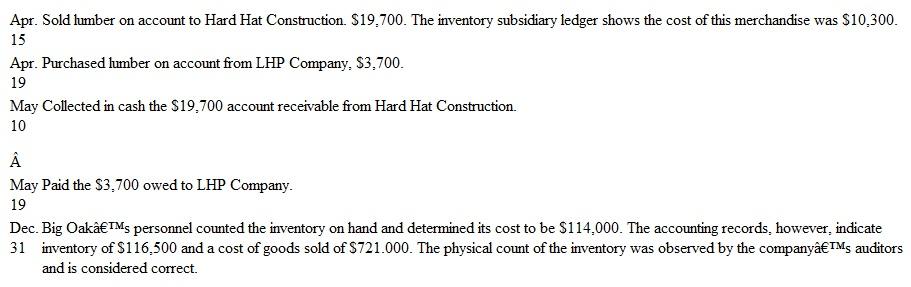

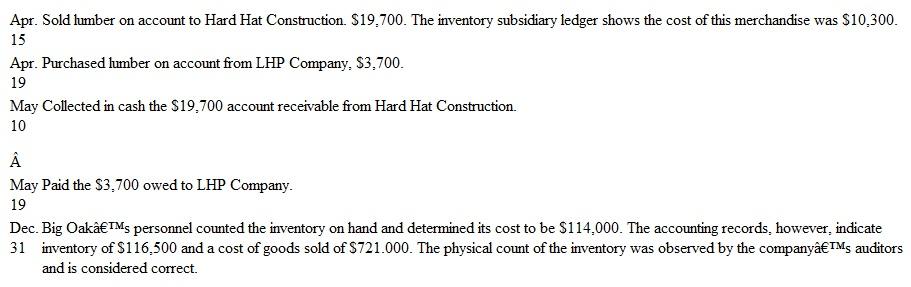

Big Oak Lumber is a lumber yard on Angel Island. Some of Big Oak's transactions during the current year are as follows:

Instructions

Instructions

a. Prepare journal entries to record these transactions and events in the accounting records of Big Oak Lumber. (The company uses a perpetual inventory system.)

b. Prepare a partial income statement showing the company's gross profit for the year. (Net sales for the year amount to $l, 422,000.)

c. Big Oak purchases merchandise inventory at the same wholesale prices as other lumber yards. Because of its remote location the company must pay between $8,000 and $18,000 per year in extra transportation charges to receive delivery of merchandise. (These additional charges are included in the amount shown as cost of goods sold.)

Assume that an index of key business ratios in your library shows lumber yards of Big Oak's approximate size (in total assets) average net sales of $1 million per year and a gross profit rate of 22 percent.

Is Big Oak able to pass its extra transportation costs on to its customers? Does the business appear to suffer or benefit financially from its remote location? Explain your reasoning and support your conclusions with specific accounting data comparing the operations of Big Oak Lumber with the industry averages.

Big Oak Lumber is a lumber yard on Angel Island. Some of Big Oak's transactions during the current year are as follows:

Instructions

Instructions a. Prepare journal entries to record these transactions and events in the accounting records of Big Oak Lumber. (The company uses a perpetual inventory system.)

b. Prepare a partial income statement showing the company's gross profit for the year. (Net sales for the year amount to $l, 422,000.)

c. Big Oak purchases merchandise inventory at the same wholesale prices as other lumber yards. Because of its remote location the company must pay between $8,000 and $18,000 per year in extra transportation charges to receive delivery of merchandise. (These additional charges are included in the amount shown as cost of goods sold.)

Assume that an index of key business ratios in your library shows lumber yards of Big Oak's approximate size (in total assets) average net sales of $1 million per year and a gross profit rate of 22 percent.

Is Big Oak able to pass its extra transportation costs on to its customers? Does the business appear to suffer or benefit financially from its remote location? Explain your reasoning and support your conclusions with specific accounting data comparing the operations of Big Oak Lumber with the industry averages.

التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255