Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 10

Merchandising Transactions

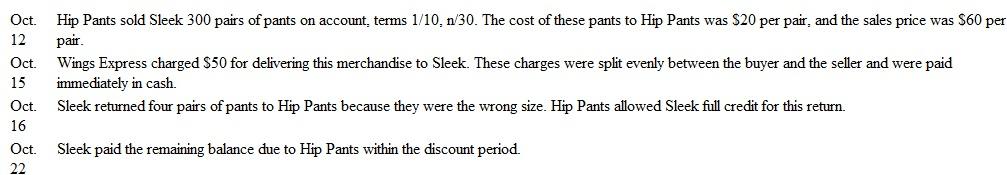

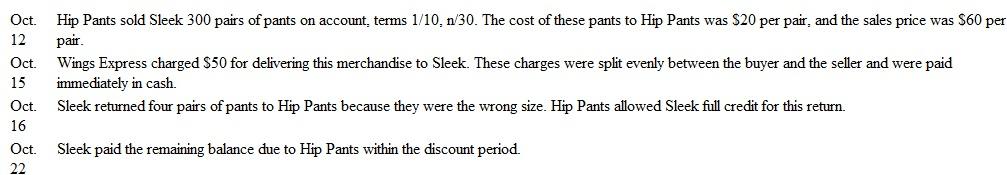

The following is a series of related transactions between Hip Pants and Sleek, a chain of retail clothing stores:

Both companies use a perpetual inventory system.

Both companies use a perpetual inventory system.

Instructions

a. Record this series of transactions in the general journal of Hip Pants. (The company records sales at gross sales price.)

b. Record this series of transactions in the general journal of Sleek. (The company records purchases of merchandise at net cost and uses a Transportation-in account to record transportation charges on inbound shipments.)

c. Sleek does not always have enough cash on hand to pay for purchases within the discount period. However, it has a line of credit with its bank, which enables Sleek to easily borrow money for short periods of time at an annual interest rate of 12 percent. (The bank charges interest only for the number of days until Sleek repays the loan.) As a matter of general policy, should Sleek take advantage of 1/10, n/30 cash discounts even if it must borrow the money to do so at an annual rate of 12 percent? Explain fully-and illustrate any supporting computations.

The following is a series of related transactions between Hip Pants and Sleek, a chain of retail clothing stores:

Both companies use a perpetual inventory system.

Both companies use a perpetual inventory system.Instructions

a. Record this series of transactions in the general journal of Hip Pants. (The company records sales at gross sales price.)

b. Record this series of transactions in the general journal of Sleek. (The company records purchases of merchandise at net cost and uses a Transportation-in account to record transportation charges on inbound shipments.)

c. Sleek does not always have enough cash on hand to pay for purchases within the discount period. However, it has a line of credit with its bank, which enables Sleek to easily borrow money for short periods of time at an annual interest rate of 12 percent. (The bank charges interest only for the number of days until Sleek repays the loan.) As a matter of general policy, should Sleek take advantage of 1/10, n/30 cash discounts even if it must borrow the money to do so at an annual rate of 12 percent? Explain fully-and illustrate any supporting computations.

التوضيح

(a) Preparing general journal entries of...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255