Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 29

Correcting Errors - Recording of Merchandising Transactions

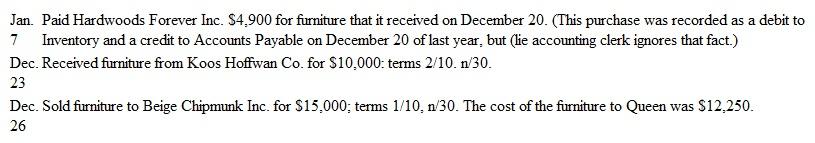

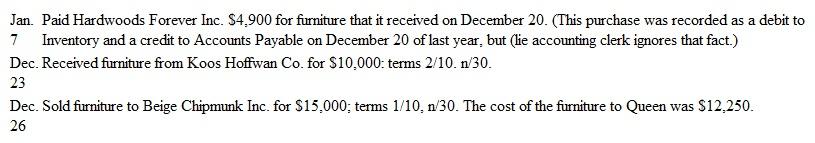

Queen Enterprises is a furniture wholesaler. Queen hired a new accounting clerk on January 1 of the current year. The new clerk does not understand accrual accounting and recorded the transactions below based on when cash receipts and disbursements changed hands rather than when the transaction occurred. Queen uses a perpetual inventory system, and its accounting policy calls for inventory purchases to be recorded net of any discounts offered.

Instructions

Instructions

a. As a result of the accounting clerk's errors, compute the amount by which the following accounts are overstated or understated:

1. Accounts Receivable

2. Inventory

3. Accounts Payable

4. Sales

5. Cost of Goods Sold

b. Compute the amount by which net income is overstated or understated.

c. Prepare a single journal entry to correct the errors that the accounting clerk has made. (Assume that Queen has yet to close its books for the current year.)

d. Assume that Queen has already closed its books for the current year. Make a single journal entry to correct the errors that the accounting clerk has made.

e. Assume that the ending inventory balance is correctly stated based on adjustments resulting from a physical inventory count. (Cost of Goods Sold was debited or credited based on the inventory adjustment.) Assume that Queen has already closed its books for the current year, and make a single journal entry to correct the errors that the accounting clerk has made.

Queen Enterprises is a furniture wholesaler. Queen hired a new accounting clerk on January 1 of the current year. The new clerk does not understand accrual accounting and recorded the transactions below based on when cash receipts and disbursements changed hands rather than when the transaction occurred. Queen uses a perpetual inventory system, and its accounting policy calls for inventory purchases to be recorded net of any discounts offered.

Instructions

Instructions a. As a result of the accounting clerk's errors, compute the amount by which the following accounts are overstated or understated:

1. Accounts Receivable

2. Inventory

3. Accounts Payable

4. Sales

5. Cost of Goods Sold

b. Compute the amount by which net income is overstated or understated.

c. Prepare a single journal entry to correct the errors that the accounting clerk has made. (Assume that Queen has yet to close its books for the current year.)

d. Assume that Queen has already closed its books for the current year. Make a single journal entry to correct the errors that the accounting clerk has made.

e. Assume that the ending inventory balance is correctly stated based on adjustments resulting from a physical inventory count. (Cost of Goods Sold was debited or credited based on the inventory adjustment.) Assume that Queen has already closed its books for the current year, and make a single journal entry to correct the errors that the accounting clerk has made.

التوضيح

a.

Entries that Should Have Been Recorde...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255