Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 41

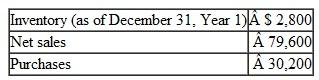

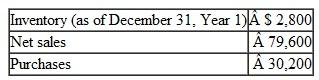

Boston Bait Shop uses a periodic inventory system. At December 31, Year 2, the accounting records include the following information:

A complete physical inventory taken at December 31. Year 2, indicates merchandise costing $3,000 remains in stock.

A complete physical inventory taken at December 31. Year 2, indicates merchandise costing $3,000 remains in stock.

a. How were the amounts of beginning and ending inventory determined?

b. Compute the amount of the cost of goods sold in Year 2.

c. Prepare two closing entries at December 31. Year 2: the first to create a Cost of Goods Sold account with the appropriate balance and the second to bring the Inventory account up-to-date.

d. Prepare a partial income statement showing the shop's gross profit for the year.

e. Describe why a company such as Boston Bait Shop would use a periodic inventory system rather than a perpetual inventory system.

A complete physical inventory taken at December 31. Year 2, indicates merchandise costing $3,000 remains in stock.

A complete physical inventory taken at December 31. Year 2, indicates merchandise costing $3,000 remains in stock.a. How were the amounts of beginning and ending inventory determined?

b. Compute the amount of the cost of goods sold in Year 2.

c. Prepare two closing entries at December 31. Year 2: the first to create a Cost of Goods Sold account with the appropriate balance and the second to bring the Inventory account up-to-date.

d. Prepare a partial income statement showing the shop's gross profit for the year.

e. Describe why a company such as Boston Bait Shop would use a periodic inventory system rather than a perpetual inventory system.

التوضيح

a.

The determination of amount of invent...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255