Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 4

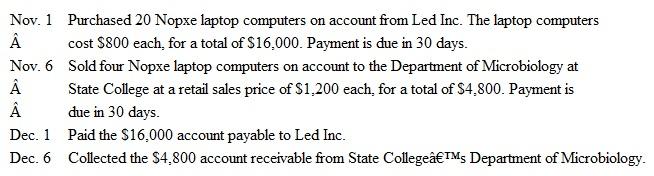

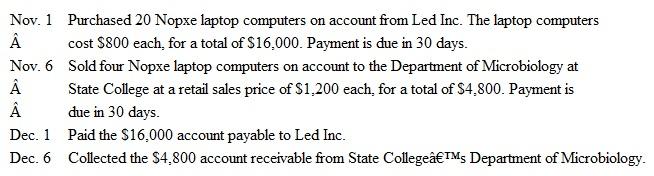

State College Technology Store (SCTS) is a retail computer store in the university center of a large mid- western university. SCTS engaged in the following transactions during November of the current year:

Assume that the other expenses inclined by SCTS during November and December were $1,000, and assume that all of these expenses were paid in cash. SCTS is not subject to income tax because it is a wholly-owned unit of a nonprofit organization. Compute the net income of SCTS during November and December using accrual accounting principles. Also, compute what SCTS's net income would have been had it used the cash basis of accounting. Explain the difference.

Assume that the other expenses inclined by SCTS during November and December were $1,000, and assume that all of these expenses were paid in cash. SCTS is not subject to income tax because it is a wholly-owned unit of a nonprofit organization. Compute the net income of SCTS during November and December using accrual accounting principles. Also, compute what SCTS's net income would have been had it used the cash basis of accounting. Explain the difference.

Assume that the other expenses inclined by SCTS during November and December were $1,000, and assume that all of these expenses were paid in cash. SCTS is not subject to income tax because it is a wholly-owned unit of a nonprofit organization. Compute the net income of SCTS during November and December using accrual accounting principles. Also, compute what SCTS's net income would have been had it used the cash basis of accounting. Explain the difference.

Assume that the other expenses inclined by SCTS during November and December were $1,000, and assume that all of these expenses were paid in cash. SCTS is not subject to income tax because it is a wholly-owned unit of a nonprofit organization. Compute the net income of SCTS during November and December using accrual accounting principles. Also, compute what SCTS's net income would have been had it used the cash basis of accounting. Explain the difference.التوضيح

The difference between the accrual-basi...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255