Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 50

Osage Farm Supply had poor internal control over its cash transactions. Facts about the company's cash position at November 30 are described below.

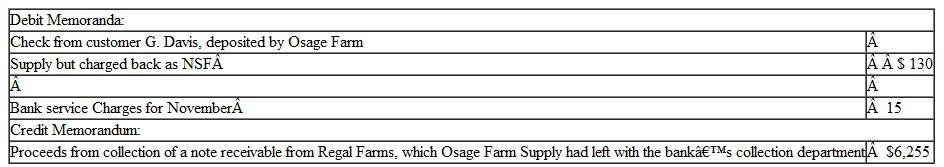

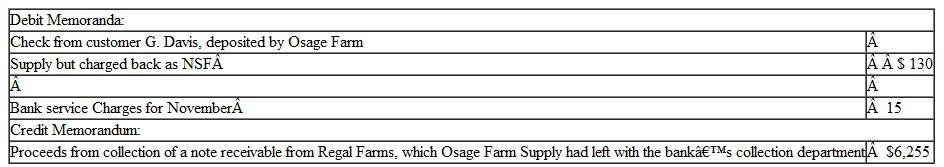

The accounting records showed a cash balance of $35,400, which included a deposit in transit of $1,245. The balance indicated in the bank statement was $20,600. Included in the bank statement were the following debit and credit memoranda:

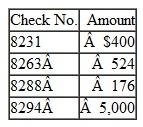

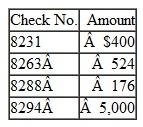

Outstanding checks were as follows:

Outstanding checks were as follows:

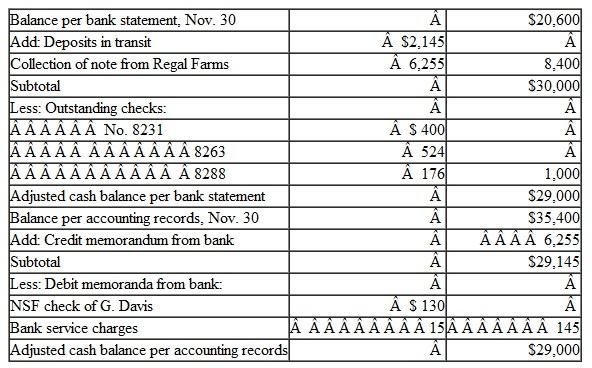

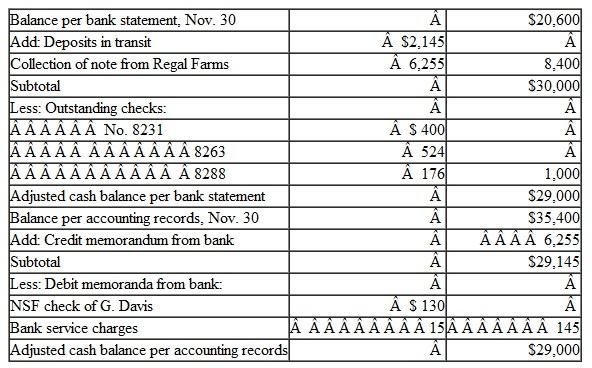

Bev Escola, the company's cashier, has been taking portions of the company's cash receipts for several months. Each month. Escola prepares the company 's bank reconciliation in a manner that conceals her thefts. Her bank reconciliation for November was as follows:

Bev Escola, the company's cashier, has been taking portions of the company's cash receipts for several months. Each month. Escola prepares the company 's bank reconciliation in a manner that conceals her thefts. Her bank reconciliation for November was as follows:

Instructions

Instructions

a. Determine the amount of the cash shortage that has been concealed by Escola in her bank reconciliation. (As a format, we suggest that you prepare the hank reconciliation correctly. The amount of the shortage then will be the difference between the adjusted balances per the bank statement and per the accounting records. You can then list this unrecorded cash shortage as the final adjustment necessary to complete your reconciliation.)

b. Carefully review Eseola's bank reconciliation and explain in detail how she concealed the amount of the shortage. Include a listing of the dollar amounts that were concealed in various ways. This listing should total the amount of the shortage determined in part a.

c. Suggest some specific internal control measures that appear to be necessary for Osage Farm Supply.

The accounting records showed a cash balance of $35,400, which included a deposit in transit of $1,245. The balance indicated in the bank statement was $20,600. Included in the bank statement were the following debit and credit memoranda:

Outstanding checks were as follows:

Outstanding checks were as follows: Bev Escola, the company's cashier, has been taking portions of the company's cash receipts for several months. Each month. Escola prepares the company 's bank reconciliation in a manner that conceals her thefts. Her bank reconciliation for November was as follows:

Bev Escola, the company's cashier, has been taking portions of the company's cash receipts for several months. Each month. Escola prepares the company 's bank reconciliation in a manner that conceals her thefts. Her bank reconciliation for November was as follows: Instructions

Instructions a. Determine the amount of the cash shortage that has been concealed by Escola in her bank reconciliation. (As a format, we suggest that you prepare the hank reconciliation correctly. The amount of the shortage then will be the difference between the adjusted balances per the bank statement and per the accounting records. You can then list this unrecorded cash shortage as the final adjustment necessary to complete your reconciliation.)

b. Carefully review Eseola's bank reconciliation and explain in detail how she concealed the amount of the shortage. Include a listing of the dollar amounts that were concealed in various ways. This listing should total the amount of the shortage determined in part a.

c. Suggest some specific internal control measures that appear to be necessary for Osage Farm Supply.

التوضيح

Bank reconciliation statement is prepare...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255