Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 35

Accounting for Uncollectible Accounts

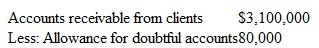

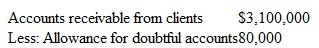

Wilcox Mills is a manufacturer that makes all sales on 30-day credit terms. Annual sales are approximately $30 million. At the end of 2014, accounts receivable were presented in the company's balance sheet as follows:

During 2015, $165,000 of specific accounts receivable were written off as uncollectible. Of these accounts written off, receivables totaling $15,000 were subsequently collected. At the end of 2015, an aging of accounts receivable indicated a need for a $90,000 allowance to cover possible failure to collect the accounts currently outstanding.

Wilcox Mills makes adjusting entries for uncollectible accounts only at year-end.

Instructions

a. Prepare the following general journal entries:

1. One entry to summarize all accounts written off against the Allowance for Doubtful Accounts during 2015.

2. Entries to record the $15,000 in accounts receivable that were subsequently collected.

3. The adjusting entry required at December 31, 2015, to increase the Allowance for Doubtful Accounts to $90,000.

b. Notice that the Allowance for Doubtful Accounts was only $80,000 at the end of 2014, but uncollectible accounts during 2015 totaled $150,000 ($165,000 less the $15,000 reinstated). Do these relationships appear reasonable, or was the Allowance for Doubtful Accounts greatly understated at the end of 2014? Explain.

Wilcox Mills is a manufacturer that makes all sales on 30-day credit terms. Annual sales are approximately $30 million. At the end of 2014, accounts receivable were presented in the company's balance sheet as follows:

During 2015, $165,000 of specific accounts receivable were written off as uncollectible. Of these accounts written off, receivables totaling $15,000 were subsequently collected. At the end of 2015, an aging of accounts receivable indicated a need for a $90,000 allowance to cover possible failure to collect the accounts currently outstanding.

Wilcox Mills makes adjusting entries for uncollectible accounts only at year-end.

Instructions

a. Prepare the following general journal entries:

1. One entry to summarize all accounts written off against the Allowance for Doubtful Accounts during 2015.

2. Entries to record the $15,000 in accounts receivable that were subsequently collected.

3. The adjusting entry required at December 31, 2015, to increase the Allowance for Doubtful Accounts to $90,000.

b. Notice that the Allowance for Doubtful Accounts was only $80,000 at the end of 2014, but uncollectible accounts during 2015 totaled $150,000 ($165,000 less the $15,000 reinstated). Do these relationships appear reasonable, or was the Allowance for Doubtful Accounts greatly understated at the end of 2014? Explain.

التوضيح

a)

During 2015, $165,000 of specific acc...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255