Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 16

Notes Receivable

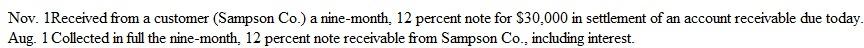

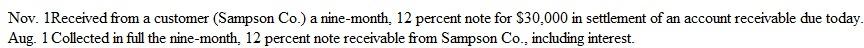

Midtown Distribution sells a variety of merchandise to retail stores on account, but it insists that any customer who fails to pay an invoice when due must replace their account receivable with an interest-bearing note. The company adjusts and closes its accounts at December 31. Among the transactions relating to notes receivable were the following:

Instructions

a. Prepare journal entries (in general journal form) to record: (1) the receipt of the note on November 1; (2) the adjustment for interest on December 31; and (3) the collection of principal and interest on August 1. (To better illustrate the allocation of interest revenue between accounting periods, we will assume Midtown makes adjusting entries only at year-end. )

b. Assume that instead of paying the note on August 1, the customer (Sampson Co.) had defaulted. Give the journal entry by Midtown to record the default. Assume that Sampson Co. has sufficient resources that the note eventually will be collected.

c. Explain why the company insists that any customer who fails to pay an invoice when due must replace it with an interest-bearing note.

Midtown Distribution sells a variety of merchandise to retail stores on account, but it insists that any customer who fails to pay an invoice when due must replace their account receivable with an interest-bearing note. The company adjusts and closes its accounts at December 31. Among the transactions relating to notes receivable were the following:

Instructions

a. Prepare journal entries (in general journal form) to record: (1) the receipt of the note on November 1; (2) the adjustment for interest on December 31; and (3) the collection of principal and interest on August 1. (To better illustrate the allocation of interest revenue between accounting periods, we will assume Midtown makes adjusting entries only at year-end. )

b. Assume that instead of paying the note on August 1, the customer (Sampson Co.) had defaulted. Give the journal entry by Midtown to record the default. Assume that Sampson Co. has sufficient resources that the note eventually will be collected.

c. Explain why the company insists that any customer who fails to pay an invoice when due must replace it with an interest-bearing note.

التوضيح

Prepare journal entries:

The receipt of...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255