Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 48

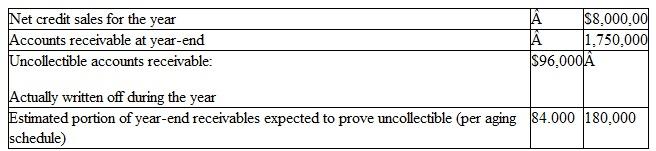

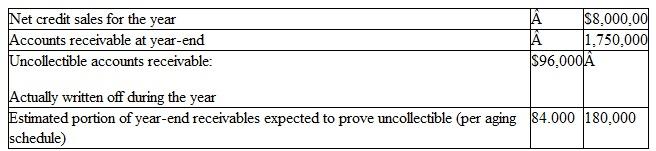

The credit manager of Montour Fuel has gathered the following information about the company's accounts receivable and credit losses during the current year:

Prepare one journal entry summarizing the recognition of uncollectible accounts expense for the

Prepare one journal entry summarizing the recognition of uncollectible accounts expense for the

entire year under each of the following independent assumptions:

a. Uncollectible accounts expense is estimated at an amount equal to 2.5 percent of net credit sales.

b. Uncollectible accounts expense is recognized by adjusting the balance in the Allowance for Doubtful Accounts to the amount indicated in the year-end aging schedule. The balance in the allowance account at the beginning of the current year was $25,000. (Consider the effect of the write-offs during the year on the balance in the Allowance for Doubtful Accounts.)

c. The company uses the direct write-off method of accounting for uncollectible accounts.

d. Which of the three methods gives investors and creditors the most accurate assessment of a company's liquidity? Defend your answer.

Prepare one journal entry summarizing the recognition of uncollectible accounts expense for the

Prepare one journal entry summarizing the recognition of uncollectible accounts expense for theentire year under each of the following independent assumptions:

a. Uncollectible accounts expense is estimated at an amount equal to 2.5 percent of net credit sales.

b. Uncollectible accounts expense is recognized by adjusting the balance in the Allowance for Doubtful Accounts to the amount indicated in the year-end aging schedule. The balance in the allowance account at the beginning of the current year was $25,000. (Consider the effect of the write-offs during the year on the balance in the Allowance for Doubtful Accounts.)

c. The company uses the direct write-off method of accounting for uncollectible accounts.

d. Which of the three methods gives investors and creditors the most accurate assessment of a company's liquidity? Defend your answer.

التوضيح

The account receivable is displayed on t...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255