Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 55

Issues Involving Alternative Depreciation Methods

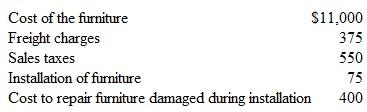

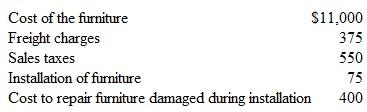

Davidson, DDS, purchased new furniture for its store on May 1, 2015. The furniture is expected to have a 10-year life and no residual value. The following expenditures were associated with the purchase:

Instructions

a. Compute depreciation expense for the years 2015 through 2018 under each depreciation method listed below:

1. Straight-line, with fractional years rounded to the nearest whole month.

2. 200 percent declining-balance, using the half-year convention.

3. 150 percent declining-balance, using the half-year convention.

b. Davidson, DDS, has two conflicting objectives. Management wants to report the highest possible earnings in its financial statements, yet it also wants to minimize its taxable income reported to the IRS. Explain how both of these objectives can be met.

c. Which of the depreciation methods applied in part a resulted in the lowest reported book value at the end of 2018? Is book value an estimate of an asset's fair value? Explain.

d. Assume that Davidson, DDS, sold the old furniture that was being replaced. The old furniture had originally cost $3,000. Its book value at the time of the sale was $400. Record the sale of the old furniture under the following conditions:

1. The furniture was sold for $780 cash.

2. The furniture was sold for $250 cash.

Davidson, DDS, purchased new furniture for its store on May 1, 2015. The furniture is expected to have a 10-year life and no residual value. The following expenditures were associated with the purchase:

Instructions

a. Compute depreciation expense for the years 2015 through 2018 under each depreciation method listed below:

1. Straight-line, with fractional years rounded to the nearest whole month.

2. 200 percent declining-balance, using the half-year convention.

3. 150 percent declining-balance, using the half-year convention.

b. Davidson, DDS, has two conflicting objectives. Management wants to report the highest possible earnings in its financial statements, yet it also wants to minimize its taxable income reported to the IRS. Explain how both of these objectives can be met.

c. Which of the depreciation methods applied in part a resulted in the lowest reported book value at the end of 2018? Is book value an estimate of an asset's fair value? Explain.

d. Assume that Davidson, DDS, sold the old furniture that was being replaced. The old furniture had originally cost $3,000. Its book value at the time of the sale was $400. Record the sale of the old furniture under the following conditions:

1. The furniture was sold for $780 cash.

2. The furniture was sold for $250 cash.

التوضيح

Calculated depreciation expense using st...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255