Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 6

Preparation and Use of an Amortization Table

On October 1, 2015, Jenco signed a four-year, $100,000 note payable to Vicksburg State Bank in conjunction with the purchase of equipment. The note calls for interest at an annual rate of 12 percent (1 percent per month). The note is fully amortizing over a period of 48 months.

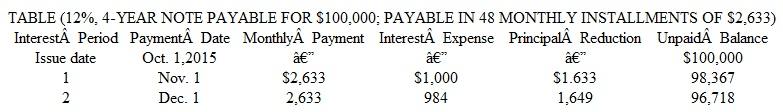

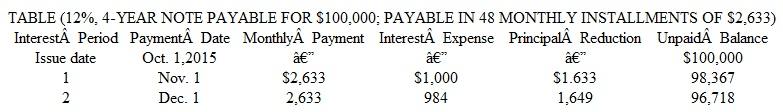

The bank sent Jenco an amortization table showing the allocation of monthly payments between interest and principal over the life of the loan. A small part of this amortization table is illustrated below. (For convenience, amounts have been rounded to the nearest dollar.)

Instructions

a. Explain whether the amounts of interest expense and the reductions in the unpaid principal are likely to change in any predictable pattern from month to month.

b. Prepare journal entries to record the first two monthly payments on this note.

c. Complete this amortization table for two more monthly installments.

d. Will any amounts relating to this four-year note be classified as current liabilities in Jenco's December 31, 2015, balance sheet? Explain, but you need not compute any additional dollar amounts.

On October 1, 2015, Jenco signed a four-year, $100,000 note payable to Vicksburg State Bank in conjunction with the purchase of equipment. The note calls for interest at an annual rate of 12 percent (1 percent per month). The note is fully amortizing over a period of 48 months.

The bank sent Jenco an amortization table showing the allocation of monthly payments between interest and principal over the life of the loan. A small part of this amortization table is illustrated below. (For convenience, amounts have been rounded to the nearest dollar.)

Instructions

a. Explain whether the amounts of interest expense and the reductions in the unpaid principal are likely to change in any predictable pattern from month to month.

b. Prepare journal entries to record the first two monthly payments on this note.

c. Complete this amortization table for two more monthly installments.

d. Will any amounts relating to this four-year note be classified as current liabilities in Jenco's December 31, 2015, balance sheet? Explain, but you need not compute any additional dollar amounts.

التوضيح

(a)

Monthly interest payment will defin...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255