Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 3

Reporting Liabilities in a Balance Sheet

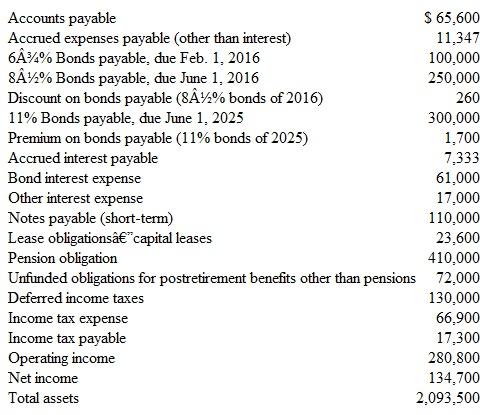

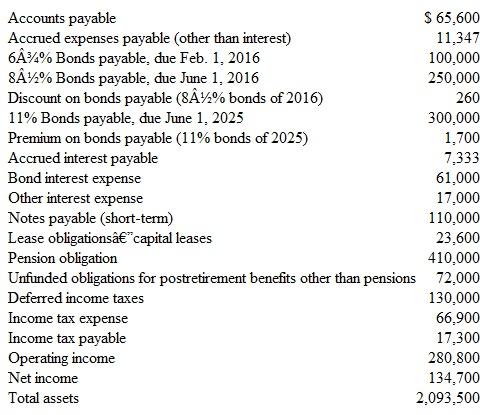

The following items were taken from the accounting records of Murfreesboro Telephone Corporation (MTC) for the year ended December 31, 2015 (dollar amounts are in thousands):

Other Information

1. The 6¾ percent bonds due in February 2016 will be refinanced in January 2016 through the issuance of $150,000 in 9 percent, 20-year bonds payable.

2. The 8½ percent bonds due June 1, 2016, will be repaid entirely from a bond sinking fund.

3. MTC is committed to total lease payments of $14,400 in 2016. Of this amount, $7,479 is applicable to operating leases, and $6,921 to capital leases. Payments on capital leases will be applied as follows: $2,300 to interest expense and $4,621 to reduction in the capitalized lease payment obligation.

4. MTC's pension plan is fully funded with an independent trustee.

5. The obligation for postretirement benefits other than pensions consists of a commitment to maintain health insurance for retired workers. During 2016, MTC will fund $18,000 of this obligation.

6. The $17,300 in income tax payable relates to income taxes levied in 2015 and must be paid on or before March 15, 2016. No portion of the deferred tax liability is regarded as a current liability.

Instructions

a. Using this information, prepare the current liabilities and long-term liabilities sections of MTC's classified balance sheet as of December 31, 2015. (Within each classification, items may be listed in any order.)

b. Explain briefly how the information in each of the six numbered paragraphs affected your presentation of the company's liabilities.

c. Compute as of December 31, 2015, MTC's (1) debt ratio and (2) interest coverage ratio.

d. Solely on the basis of information stated in this problem, indicate whether this company appears to be an outstanding, medium, or poor long-term credit risk. State specific reasons for your conclusion.

The following items were taken from the accounting records of Murfreesboro Telephone Corporation (MTC) for the year ended December 31, 2015 (dollar amounts are in thousands):

Other Information

1. The 6¾ percent bonds due in February 2016 will be refinanced in January 2016 through the issuance of $150,000 in 9 percent, 20-year bonds payable.

2. The 8½ percent bonds due June 1, 2016, will be repaid entirely from a bond sinking fund.

3. MTC is committed to total lease payments of $14,400 in 2016. Of this amount, $7,479 is applicable to operating leases, and $6,921 to capital leases. Payments on capital leases will be applied as follows: $2,300 to interest expense and $4,621 to reduction in the capitalized lease payment obligation.

4. MTC's pension plan is fully funded with an independent trustee.

5. The obligation for postretirement benefits other than pensions consists of a commitment to maintain health insurance for retired workers. During 2016, MTC will fund $18,000 of this obligation.

6. The $17,300 in income tax payable relates to income taxes levied in 2015 and must be paid on or before March 15, 2016. No portion of the deferred tax liability is regarded as a current liability.

Instructions

a. Using this information, prepare the current liabilities and long-term liabilities sections of MTC's classified balance sheet as of December 31, 2015. (Within each classification, items may be listed in any order.)

b. Explain briefly how the information in each of the six numbered paragraphs affected your presentation of the company's liabilities.

c. Compute as of December 31, 2015, MTC's (1) debt ratio and (2) interest coverage ratio.

d. Solely on the basis of information stated in this problem, indicate whether this company appears to be an outstanding, medium, or poor long-term credit risk. State specific reasons for your conclusion.

التوضيح

a.

Prepare the current and long-term li...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255