Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 33

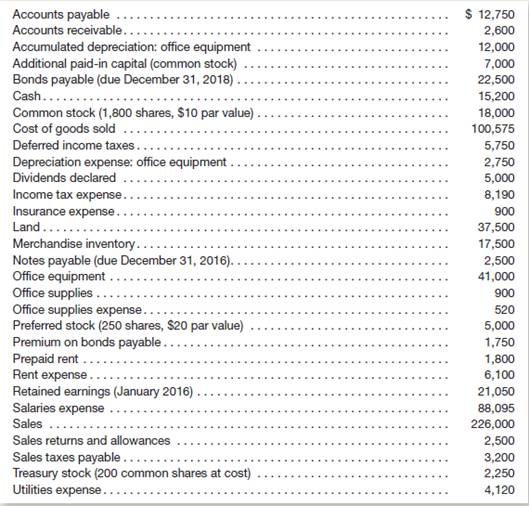

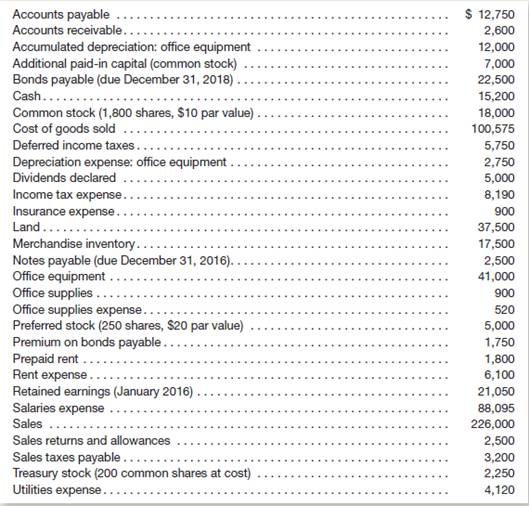

Springdale Retail, Inc.

Springdale Retail, Inc., is a retailer that has engaged you to assist in the preparation of its financial statements at December 31, 2015. Following are the correct adjusted account balances, in alphabetical order, as of that date. Each balance is the "normal" balance for that account. (Hint: The "normal" balance is the same as the debit or credit side that increases the account.)

Instructions

a. Prepare an income statement for the year ended December 31, 2015, which includes amounts for gross profit, income before income taxes, and net income. List expenses (other than cost of goods sold and income tax expense) in order, from the largest to the smallest dollar balance. You may ignore earnings per share.

b. Prepare a statement of retained earnings for the year ending December 31, 2015.

c. Prepare a statement of financial position (balance sheet) as of December 31, 2015, following these guidelines:

• Include separate asset and liability categories for those assets which are "current."

• Include and label amounts for total assets, total liabilities, total stockholders' equity, and total liabilities and stockholders' equity.

• Present deferred income taxes as a noncurrent liability.

• To the extent information is available that should be disclosed, include that information in your statement.

Springdale Retail, Inc., is a retailer that has engaged you to assist in the preparation of its financial statements at December 31, 2015. Following are the correct adjusted account balances, in alphabetical order, as of that date. Each balance is the "normal" balance for that account. (Hint: The "normal" balance is the same as the debit or credit side that increases the account.)

Instructions

a. Prepare an income statement for the year ended December 31, 2015, which includes amounts for gross profit, income before income taxes, and net income. List expenses (other than cost of goods sold and income tax expense) in order, from the largest to the smallest dollar balance. You may ignore earnings per share.

b. Prepare a statement of retained earnings for the year ending December 31, 2015.

c. Prepare a statement of financial position (balance sheet) as of December 31, 2015, following these guidelines:

• Include separate asset and liability categories for those assets which are "current."

• Include and label amounts for total assets, total liabilities, total stockholders' equity, and total liabilities and stockholders' equity.

• Present deferred income taxes as a noncurrent liability.

• To the extent information is available that should be disclosed, include that information in your statement.

التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255