Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 22

Analysis of an Equity Section of a Balance Sheet

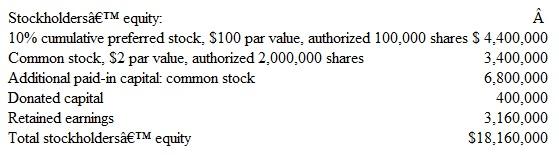

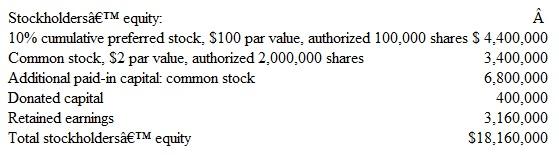

The year-end balance sheet of Mirror, Inc., includes the following stockholders' equity section (with certain details omitted):

Instructions

From this information, compute answers to the following questions:

a. How many shares of preferred stock have been issued?

b. What is the total amount of the annual dividends paid to preferred stockholders?

c. How many shares of common stock are outstanding?

d. What was the average issuance price per share of common stock?

e. What is the amount of legal capital?

f. What is the total amount of paid-in capital?

g. What is the book value per share of common stock? (There are no dividends in arrears.)

h. Assume that retained earnings at the beginning of the year amounted to $1,200,000 and the net income for the year was $4,800,000. What was the dividend declared during the year on each share of common stock? (Hint: Net income increases retained earnings, whereas dividends decrease retained earnings.)

The year-end balance sheet of Mirror, Inc., includes the following stockholders' equity section (with certain details omitted):

Instructions

From this information, compute answers to the following questions:

a. How many shares of preferred stock have been issued?

b. What is the total amount of the annual dividends paid to preferred stockholders?

c. How many shares of common stock are outstanding?

d. What was the average issuance price per share of common stock?

e. What is the amount of legal capital?

f. What is the total amount of paid-in capital?

g. What is the book value per share of common stock? (There are no dividends in arrears.)

h. Assume that retained earnings at the beginning of the year amounted to $1,200,000 and the net income for the year was $4,800,000. What was the dividend declared during the year on each share of common stock? (Hint: Net income increases retained earnings, whereas dividends decrease retained earnings.)

التوضيح

By analysis the data following observati...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255