Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 23

Prepare and Analyze a Statement of Cash Flows; Involves Preparation of a Worksheet

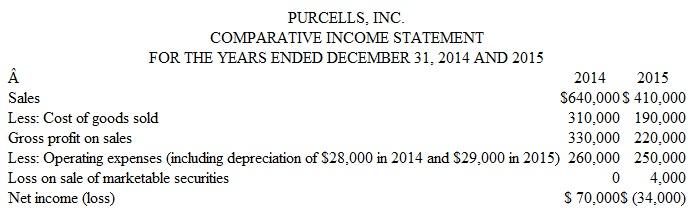

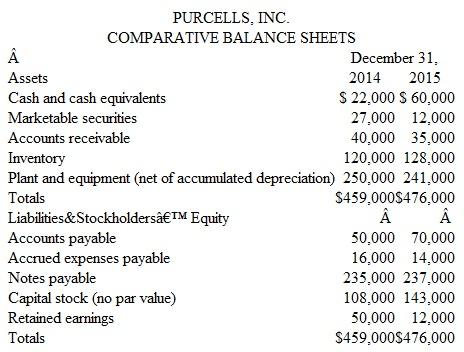

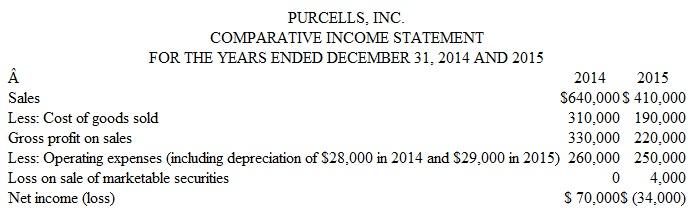

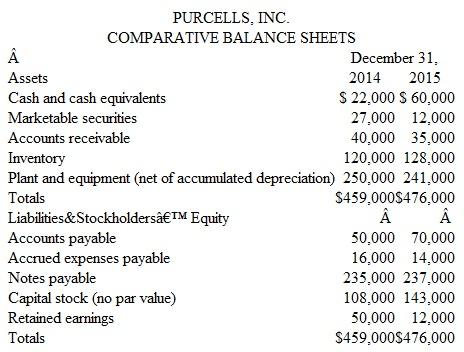

Purcells, Inc., sells a single product (Pulsa) exclusively through newspaper advertising. The comparative income statements and balance sheets are for the past two years.

Additional Information

Additional Information

The following information regarding the company's operations in 2015 is available from the company's accounting records:

1. Early in the year the company declared and paid a $4,000 cash dividend.

2. During the year marketable securities costing $15,000 were sold for $11,000 cash, resulting in a $4,000 nonoperating loss.

3. The company purchased plant assets for $20,000, paying $8,000 in cash and issuing a note payable for the $12,000 balance.

4. During the year the company repaid a $10,000 note payable, but incurred an additional $12,000 in long-term debt as described in 3, above.

5. The owners invested $35,000 cash in the business as a condition of the new loans described in paragraphs 3 and 4, above.

Instructions

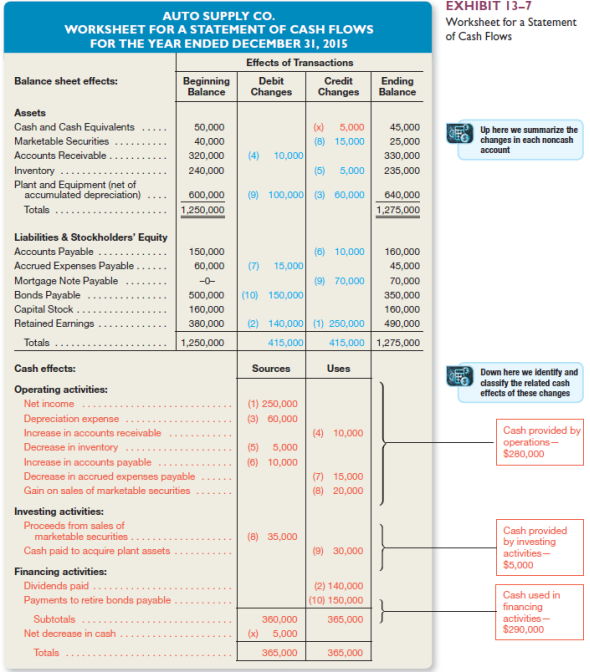

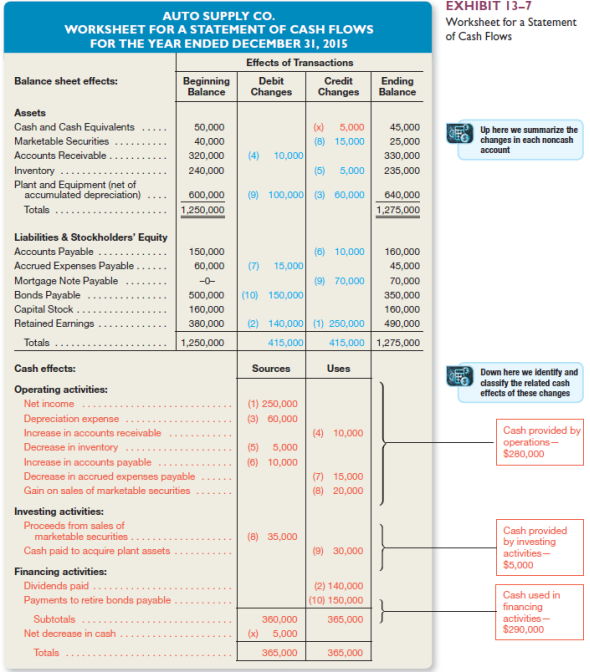

a. Prepare a worksheet for a statement of cash flows, following the example shown in Exhibit 13-7.

b. Prepare a formal statement of cash flows for 2011, including a supplementary schedule of noncash investing and financing activities. (Use the format illustrated in Exhibit 13-8. Cash provided by operating activities is to be presented by the indirect method. )

c. Explain how Purcells, Inc., achieved positive cash flows from operating activities, despite incurring a net loss for the year.

EXHIBIT 13-7

Worksheet for a Statement of Cash Flows

EXHIBIT 13-8

Auto Supply Co. Statement of Cash Flows

Purcells, Inc., sells a single product (Pulsa) exclusively through newspaper advertising. The comparative income statements and balance sheets are for the past two years.

Additional Information

Additional Information The following information regarding the company's operations in 2015 is available from the company's accounting records:

1. Early in the year the company declared and paid a $4,000 cash dividend.

2. During the year marketable securities costing $15,000 were sold for $11,000 cash, resulting in a $4,000 nonoperating loss.

3. The company purchased plant assets for $20,000, paying $8,000 in cash and issuing a note payable for the $12,000 balance.

4. During the year the company repaid a $10,000 note payable, but incurred an additional $12,000 in long-term debt as described in 3, above.

5. The owners invested $35,000 cash in the business as a condition of the new loans described in paragraphs 3 and 4, above.

Instructions

a. Prepare a worksheet for a statement of cash flows, following the example shown in Exhibit 13-7.

b. Prepare a formal statement of cash flows for 2011, including a supplementary schedule of noncash investing and financing activities. (Use the format illustrated in Exhibit 13-8. Cash provided by operating activities is to be presented by the indirect method. )

c. Explain how Purcells, Inc., achieved positive cash flows from operating activities, despite incurring a net loss for the year.

EXHIBIT 13-7

Worksheet for a Statement of Cash Flows

EXHIBIT 13-8

Auto Supply Co. Statement of Cash Flows

التوضيح

a.

Working for the Statement of Cash Fl...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255