Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 39

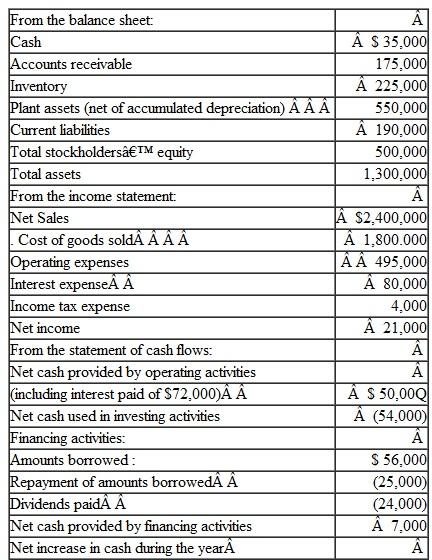

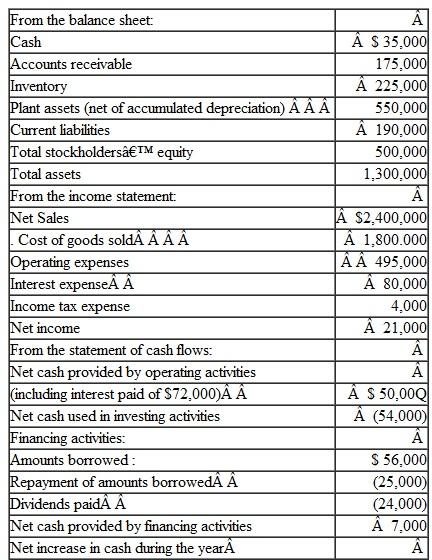

Shown below are selected data from the financial statements of Hamilton Stores, a retail lighting store.

Instructions

Instructions

a. Explain how the interest expense shown in the income statement could be $80,000, when the interest payment appearing in the statement of cash flows is only $72,000.

b. Compute the following (round to one decimal place):

1. Current ratio

2. Quick ratio

3. Working capital

4. Debt ratio

c. Comment on these measurements and evaluate Hamilton's short-term debt-paying ability.

d. Compute the following ratios (assume that the year-end amounts of total assets and total stockholders' equity also represent the average amounts throughout the year):

1. Return on assets

2. Return on equity

e. Comment on the company's performance under these measurements. Explain why the return on assets and return on equity are so different.

f. Discuss (1) the apparent safety of long-term creditors' claims and (2) the prospects for Hamilton Stores continuing its dividend payments at the present level.

Instructions

Instructions a. Explain how the interest expense shown in the income statement could be $80,000, when the interest payment appearing in the statement of cash flows is only $72,000.

b. Compute the following (round to one decimal place):

1. Current ratio

2. Quick ratio

3. Working capital

4. Debt ratio

c. Comment on these measurements and evaluate Hamilton's short-term debt-paying ability.

d. Compute the following ratios (assume that the year-end amounts of total assets and total stockholders' equity also represent the average amounts throughout the year):

1. Return on assets

2. Return on equity

e. Comment on the company's performance under these measurements. Explain why the return on assets and return on equity are so different.

f. Discuss (1) the apparent safety of long-term creditors' claims and (2) the prospects for Hamilton Stores continuing its dividend payments at the present level.

التوضيح

b.

c. By traditional measures, the co...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255