Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 55

Basic Ratio Analysis

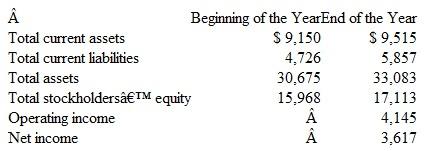

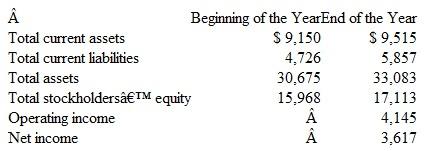

Medtronics is a world leader in medical technology. The following selected data are adapted from a recent annual report. (Dollar amounts are stated in millions.)

The company has long-term liabilities that bear interest at annual rates ranging from 6 percent to 8 percent.

Instructions

a. Compute the company's current ratio at ( 1 ) the beginning of the year and ( 2 ) the end of the year. (Carry to two decimal places.)

b. Compute the company's working capital at ( 1 ) the beginning of the year and ( 2 ) the end of the year. (Express dollar amounts in thousands.)

c. Is the company's short-term debt-paying ability improving or deteriorating?

d. Compute the company's ( 1 ) return on average total assets and ( 2 ) return on average stockholders' equity. (Round average assets and average equity to the nearest dollar and final computations to the nearest 1 percent.)

e. As an equity investor, do you think that Medtronic 's management is utilizing the company's resources in a reasonably efficient manner? Explain.

Medtronics is a world leader in medical technology. The following selected data are adapted from a recent annual report. (Dollar amounts are stated in millions.)

The company has long-term liabilities that bear interest at annual rates ranging from 6 percent to 8 percent.

Instructions

a. Compute the company's current ratio at ( 1 ) the beginning of the year and ( 2 ) the end of the year. (Carry to two decimal places.)

b. Compute the company's working capital at ( 1 ) the beginning of the year and ( 2 ) the end of the year. (Express dollar amounts in thousands.)

c. Is the company's short-term debt-paying ability improving or deteriorating?

d. Compute the company's ( 1 ) return on average total assets and ( 2 ) return on average stockholders' equity. (Round average assets and average equity to the nearest dollar and final computations to the nearest 1 percent.)

e. As an equity investor, do you think that Medtronic 's management is utilizing the company's resources in a reasonably efficient manner? Explain.

التوضيح

(a) Computation of current ratios:

Curr...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255