Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 11

Ratios; Consider Advisability of Incurring Long-Term Debt

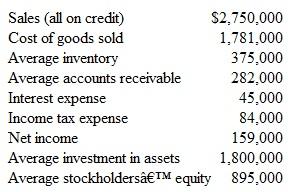

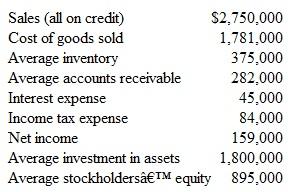

At the end of the year, the following information was obtained from the accounting records of Harrison Electronics, Inc.

Instructions

a. From the information given, compute the following:

1. Inventory turnover.

2. Accounts receivable turnover.

3. Total operating expenses.

4. Gross profit percentage.

5. Return on average stockholders' equity.

6. Return on average assets.

b. Harrison Electronics has an opportunity to obtain a long-term loan at an annual interest rate of 10 percent and could use this additional capital at the same rate of profitability as indicated by the given data. Would obtaining the loan be desirable from the viewpoint of the stockholders? Explain.

At the end of the year, the following information was obtained from the accounting records of Harrison Electronics, Inc.

Instructions

a. From the information given, compute the following:

1. Inventory turnover.

2. Accounts receivable turnover.

3. Total operating expenses.

4. Gross profit percentage.

5. Return on average stockholders' equity.

6. Return on average assets.

b. Harrison Electronics has an opportunity to obtain a long-term loan at an annual interest rate of 10 percent and could use this additional capital at the same rate of profitability as indicated by the given data. Would obtaining the loan be desirable from the viewpoint of the stockholders? Explain.

التوضيح

(a) Compute the following ratios:

(1) I...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255